Cross-Border Taxation Documents

Cross-Border Taxation

Frequently Asked Questions on Waiver

This document provides comprehensive information and instructions regarding waiver applications for taxpayers. It outlines the eligibility criteria, application process, and necessary documentation required for submission. Users will find insights into handling penalties and interest related to tax compliance.

Cross-Border Taxation

Massachusetts Withholding by Pass-Through Entities Guide

This file provides essential information regarding Massachusetts withholding tax obligations for pass-through entities. It outlines exemptions, necessary forms, and compliance requirements. Businesses and individuals involved with pass-through entities will benefit from understanding these regulations.

Cross-Border Taxation

Schedule 2 Form 1040 Tax Additional Taxes

Schedule 2 Form 1040 is a crucial tax document required by individuals filling their federal income tax. It includes various additional taxes applicable for different scenarios. Always ensure to attach this form to your main tax return for accurate tax reporting.

Cross-Border Taxation

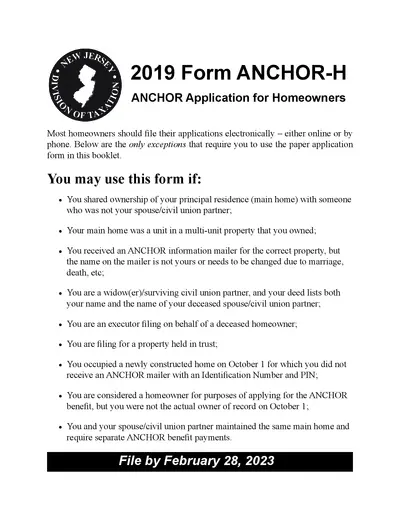

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Cross-Border Taxation

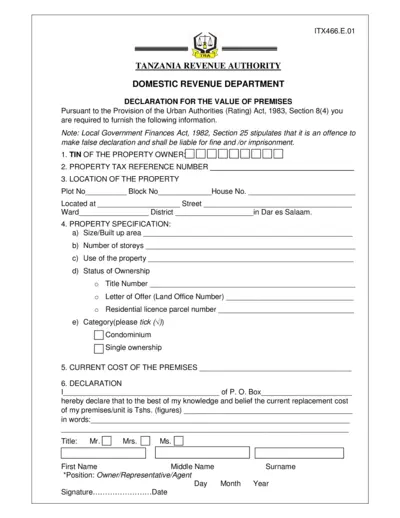

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

Cross-Border Taxation

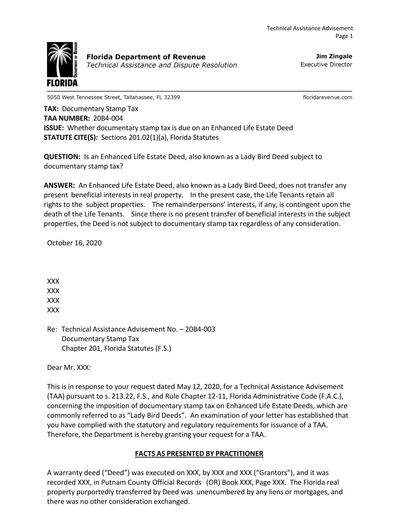

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Cross-Border Taxation

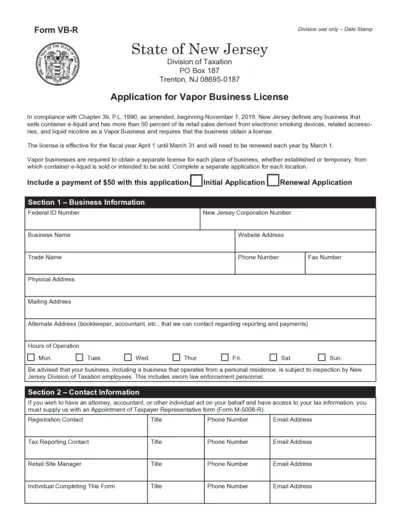

New Jersey Vapor Business License Application

This file is an application for a New Jersey Vapor Business License. It includes various sections for business information, contact details, ownership details, and types of products sold. It must be completed and submitted with a $50 payment.

Cross-Border Taxation

Form 4868 U.S. Individual Income Tax Extension

Form 4868 allows taxpayers to apply for an automatic extension to file their U.S. individual income tax return. This form provides additional time to file without incurring penalties. Ensure to understand the details required to fill out the form accurately.

Cross-Border Taxation

Guyana Taxpayer Identification Number Application

This file contains the application form for obtaining a Taxpayer Identification Number (TIN) in Guyana. It includes detailed instructions for individual applicants. Proper completion of the form is essential for successful registration.

Cross-Border Taxation

General Instructions for Information Returns 2018

This file provides essential guidelines for completing various IRS information return forms, including 1096 and 1099 series. It's crucial for filers to understand the requirements and due dates to ensure compliance with tax obligations. The instructions help navigate the complexities of U.S. tax reporting.

Cross-Border Taxation

California Sales Tax Guide for Veterinarians

This publication serves as a comprehensive guide to understanding California's Sales and Use Tax Law for veterinary practices. It is essential for veterinarians and related businesses needing clarity on tax regulations. Contact our Customer Service for further assistance.

Cross-Border Taxation

W-8IMY Instructions for Foreign Entities Tax Compliance

This file provides comprehensive instructions for Form W-8IMY. It is essential for foreign intermediaries, entities, and certain U.S. branches regarding U.S. tax withholding and reporting. Users will find guidance on completing the form to ensure compliance with IRS regulations.