Cross-Border Taxation Documents

Cross-Border Taxation

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

Cross-Border Taxation

Gujarat Commercial Tax Dealer Registration and E-Services FAQs

This file contains FAQs regarding dealer registration, downloading certificates, submitting grievances, and making e-payments. It covers various e-services provided by the Gujarat Commercial Tax Department.

Cross-Border Taxation

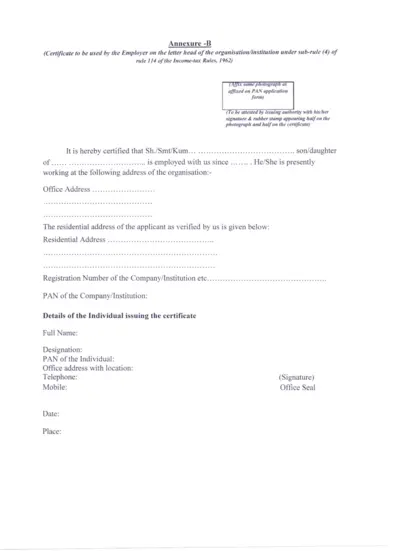

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

Cross-Border Taxation

New York State Exempt Organization Certification

This document is the New York State Exempt Organization Certification form. It certifies that an organization is exempt from state and local sales and compensating use taxes. This certification must be filled out completely to be valid.

Cross-Border Taxation

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

Cross-Border Taxation

Tax Penalties Analysis and Instructions

This document provides a comprehensive analysis of tax penalties related to failure to file, failure to pay, and estimated tax penalties under the Internal Revenue Code. It reviews case decisions issued by federal courts and outlines taxpayer rights impacted by these penalties. Users will find legislative recommendations and most litigated issues concerning tax penalties.

Cross-Border Taxation

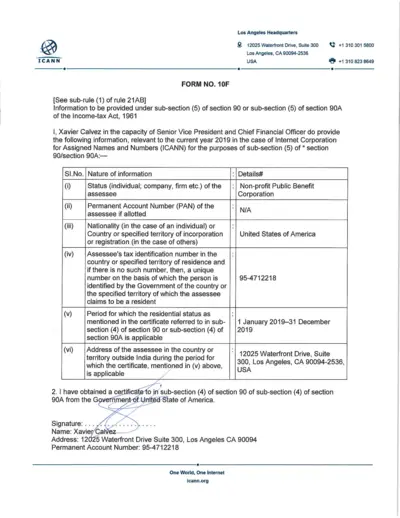

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

Cross-Border Taxation

Instructions for Form 9465 Installment Agreement Request

Instructions for Form 9465 provide guidance on how to request a monthly installment plan for taxes owed. It includes information on installment agreement fees, payment methods, and eligibility criteria. Follow these instructions to successfully complete and submit Form 9465.

Cross-Border Taxation

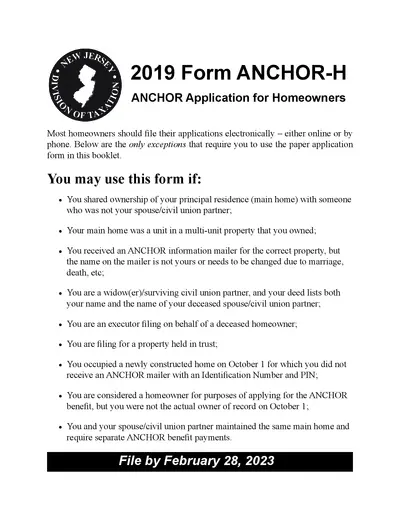

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Cross-Border Taxation

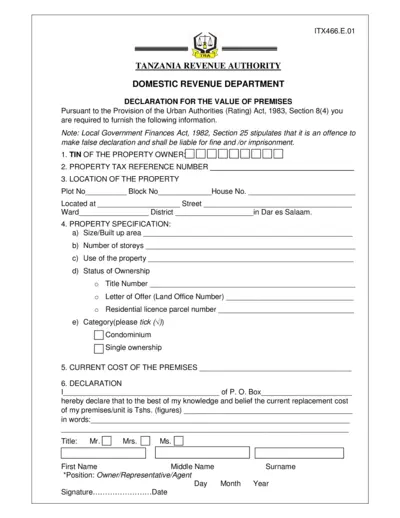

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

Cross-Border Taxation

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Cross-Border Taxation

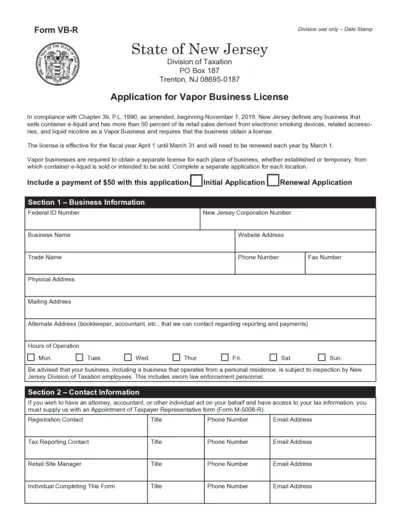

New Jersey Vapor Business License Application

This file is an application for a New Jersey Vapor Business License. It includes various sections for business information, contact details, ownership details, and types of products sold. It must be completed and submitted with a $50 payment.