Cross-Border Taxation Documents

Cross-Border Taxation

Instructions for Form 1040-X, Amended U.S. Individual Income Tax Return

This file provides detailed instructions for filling out Form 1040-X, which is used to amend U.S. individual income tax returns. It includes information on when to file, special situations, and interest and penalties. The instructions also cover specific lines and fields in the form, as well as how to assemble your return and where to file it.

Cross-Border Taxation

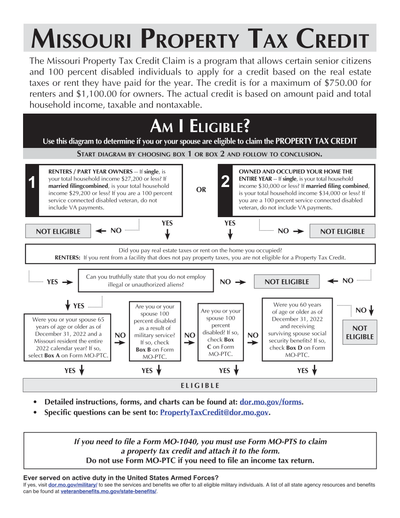

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

Audit Report for Tamil Nadu VAT Compliance

This audit report is vital for businesses to comply with the Tamil Nadu Value Added Tax Act. It ensures accurate reporting of tax details. Complete the form to validate compliance and audit procedures.

Cross-Border Taxation

New Jersey Beverage Tax Inventory Record Form

This file is the R-40 (04-16) form used by the New Jersey Department of the Treasury, Division of Taxation. It is used by licensed distillers, rectifiers, and blenders to record transactions and operations affecting the inventory of federal-tax paid stock. This includes inventory on licensed manufacturing premises or in federal-tax paid sections of licensed public warehouses.

Cross-Border Taxation

Instructions for Filling Form No. 49B - TDS/TCS Application

Form No. 49B is essential for taxpayers needing to obtain a Tax Deduction and Collection Account Number. This document provides detailed instructions for completing the form accurately to ensure compliance with tax regulations. It is critical for entities required to deduct or collect tax at source.

Cross-Border Taxation

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

Cross-Border Taxation

Gujarat Commercial Tax Dealer Registration and E-Services FAQs

This file contains FAQs regarding dealer registration, downloading certificates, submitting grievances, and making e-payments. It covers various e-services provided by the Gujarat Commercial Tax Department.

Cross-Border Taxation

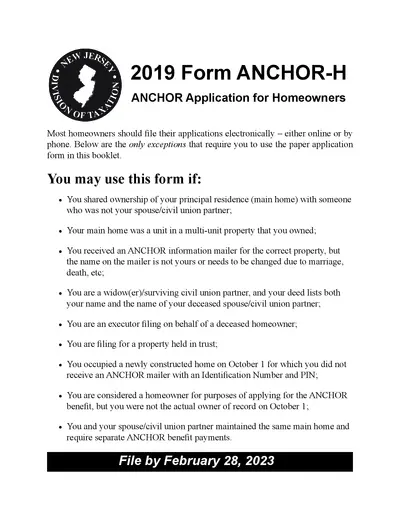

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Cross-Border Taxation

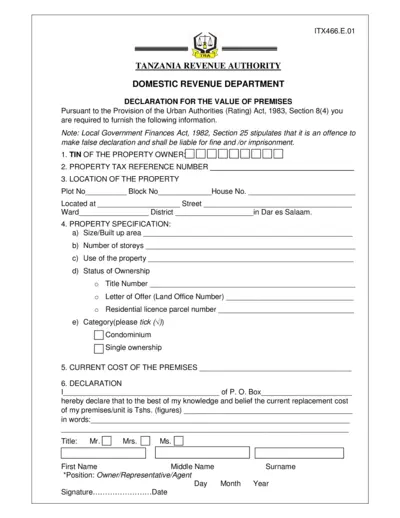

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

Cross-Border Taxation

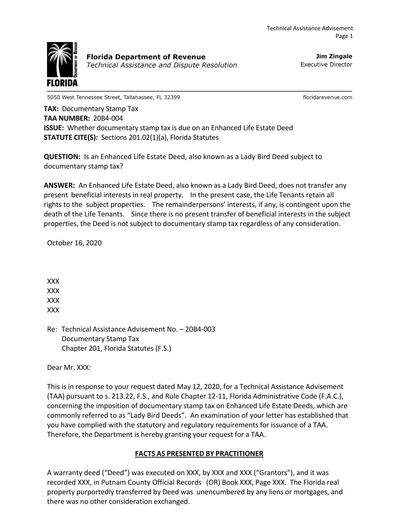

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Cross-Border Taxation

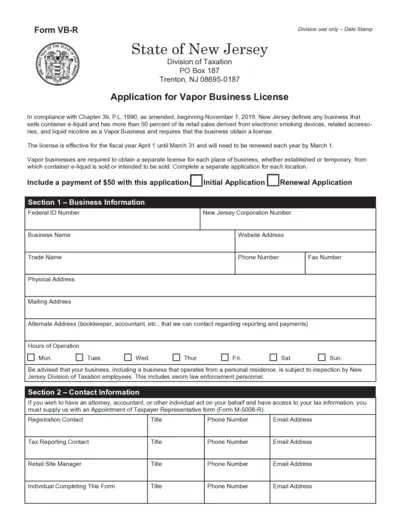

New Jersey Vapor Business License Application

This file is an application for a New Jersey Vapor Business License. It includes various sections for business information, contact details, ownership details, and types of products sold. It must be completed and submitted with a $50 payment.

Cross-Border Taxation

Form 4868 U.S. Individual Income Tax Extension

Form 4868 allows taxpayers to apply for an automatic extension to file their U.S. individual income tax return. This form provides additional time to file without incurring penalties. Ensure to understand the details required to fill out the form accurately.