Tax Documents

Cross-Border Taxation

Application for Tax Directive Gratuities IRP3(a)

The Application for a Tax Directive (IRP3(a)) is essential for taxpayers who are seeking tax directives for gratuities. It provides instructions for filling out the form correctly and details the necessary information required for processing. This document is vital for ensuring compliance with South African tax regulations.

Tax Residency

Internal Medicine Residency Program at Mount Sinai

This file provides comprehensive details about the Internal Medicine Residency Program at Mount Sinai Beth Israel. It offers valuable insights into the program structure, application process, and contact information for prospective residents. Ideal for applicants looking to join a prestigious residency program in New York.

Cross-Border Taxation

Kansas Department of Revenue Exemption Certificate

This document serves as a designated or generic exemption certificate for sales and use tax in Kansas. It is essential for various tax-exempt entities to claim exemptions on their purchases. Ensure to complete it correctly to avoid tax liabilities.

Cross-Border Taxation

IRS Statutory Notices of Deficiency Explained

This document provides essential information about IRS statutory notices of deficiency and their implications for taxpayers. It details taxpayer rights, the notice process, and guidance on challenging IRS claims. Understanding these notices is vital for taxpayers to navigate their tax responsibilities effectively.

Tax Returns

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Federal Tax Forms

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

Payroll Tax

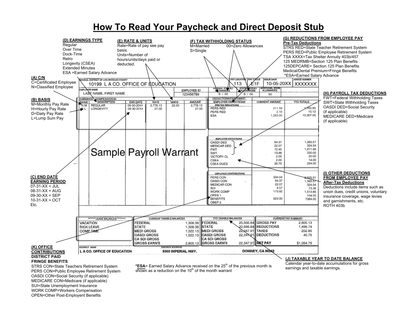

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

Cross-Border Taxation

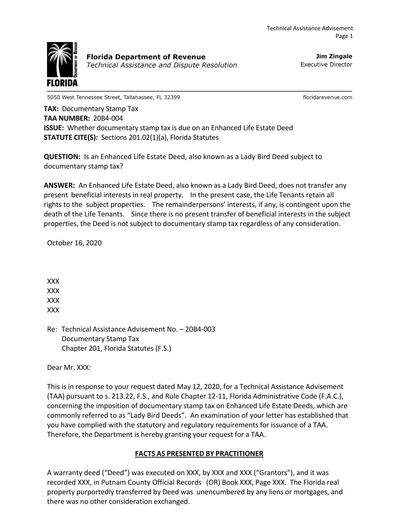

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Income Verification

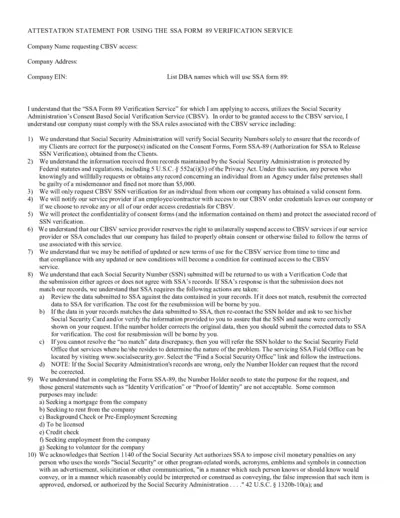

Attestation Statement for SSA Form 89 Verification

This file contains the attestation statement for using the SSA Form 89 Verification Service. It includes the rules and requirements for accessing the CBSV service. Additionally, it outlines the responsibilities for safeguarding Personal Identifiable Information (PII).

Cross-Border Taxation

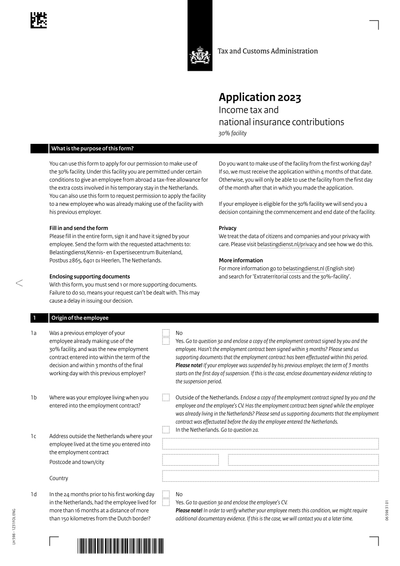

Tax and Customs Administration Application 2023

This file contains the application process for the Income Tax and National Insurance contributions concerning the 30% facility. It provides essential guidelines for employers seeking tax relief for expatriate employees in the Netherlands. Follow the detailed instructions to ensure proper completion and submission of this form.

Cross-Border Taxation

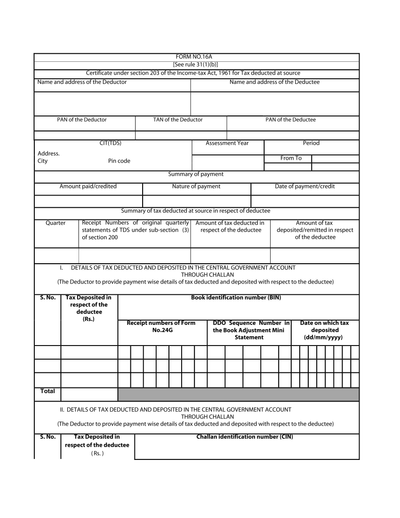

Form 16A: Tax Deducted at Source Certificate

Form 16A is a certificate under the Income-tax Act, 1961 for tax deducted at source (TDS). This document serves as proof of tax deducted by the deductor on behalf of the deductee. It is essential for taxpayers to file their income tax returns correctly.

Cross-Border Taxation

Request for Prompt Tax Assessment Form 4810

Form 4810 enables users to request a prompt assessment of tax under IRS regulations. It is essential for individuals and entities needing quick tax assessments. Ensure all relevant documentation is provided with the form to expedite processing.