Tax Documents

Tax Returns

Comprehensive Returns Instructions and Policies

This document provides detailed information about our return policies, including how to initiate a return and what items are eligible. It outlines the conditions for returning merchandise and provides a form for processing exchanges or returns. Customers can find all the necessary steps to ensure a smooth return process.

Federal Tax Forms

Direct Deposit Sign-Up Form for Federal Benefit Payments

This form is used to sign up for direct deposit of federal benefit payments such as social security, supplemental security income, and civil retirement. Follow the instructions carefully to ensure your request is processed correctly. Contact the relevant federal agency for help if needed.

Cross-Border Taxation

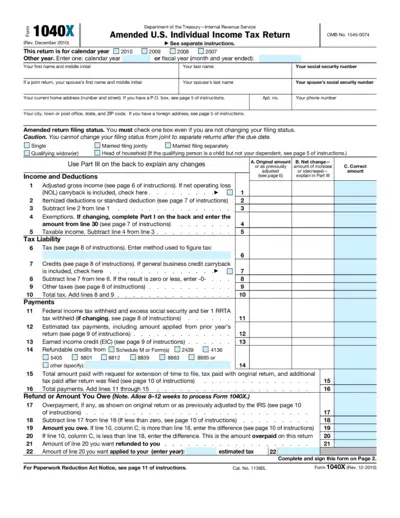

Amended U.S. Individual Income Tax Return (Form 1040X)

Form 1040X is the Amended U.S. Individual Income Tax Return for correcting your previously filed tax return. This form allows taxpayers to make changes to their filing status, income, deductions, or credits. It's essential for ensuring your tax records are accurate and up to date.

Cross-Border Taxation

New Jersey Beverage Tax Inventory Record Form

This file is the R-40 (04-16) form used by the New Jersey Department of the Treasury, Division of Taxation. It is used by licensed distillers, rectifiers, and blenders to record transactions and operations affecting the inventory of federal-tax paid stock. This includes inventory on licensed manufacturing premises or in federal-tax paid sections of licensed public warehouses.

Cross-Border Taxation

2023 Personal Tax Credits Return TD1 for Canada

The 2023 Personal Tax Credits Return (TD1) is essential for Canadians to specify tax deductions and credits accurately. This form helps determine how much tax is deducted from your pay. It contains various fields to report personal amounts and caregiving credits.

Cross-Border Taxation

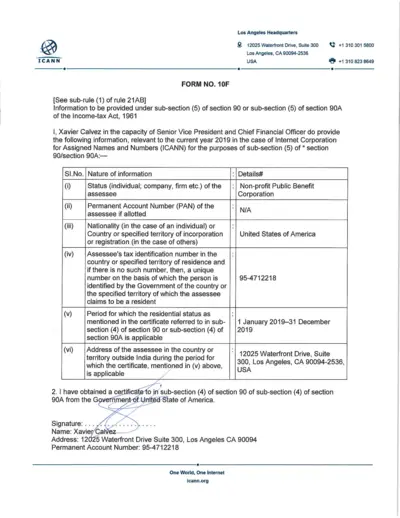

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

Cross-Border Taxation

Audit Report for Tamil Nadu VAT Compliance

This audit report is vital for businesses to comply with the Tamil Nadu Value Added Tax Act. It ensures accurate reporting of tax details. Complete the form to validate compliance and audit procedures.

Federal Tax Forms

COMPLAINT OF DISCRIMINATION IN THE FEDERAL GOVERNMENT

This file is used for filing complaints of discrimination within the federal government. It includes sections for contact information, details of the complaint, and additional information. It is essential for those who believe they have faced discrimination.

Cross-Border Taxation

Form 4868 U.S. Individual Income Tax Extension

Form 4868 allows taxpayers to apply for an automatic extension to file their U.S. individual income tax return. This form provides additional time to file without incurring penalties. Ensure to understand the details required to fill out the form accurately.

Cross-Border Taxation

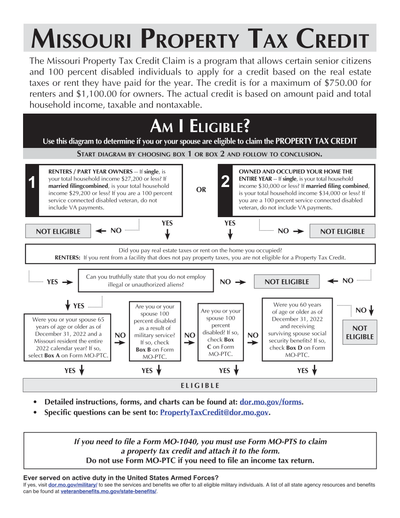

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

Philippine Tax Clearance Certificate - Essential Information

This document is a Tax Clearance Certificate issued by the Bureau of Internal Revenue in the Philippines. It verifies that the taxpayer has met all taxation criteria as of the certification date. Valid from May 27, 2022, to May 27, 2023.

Tax Returns

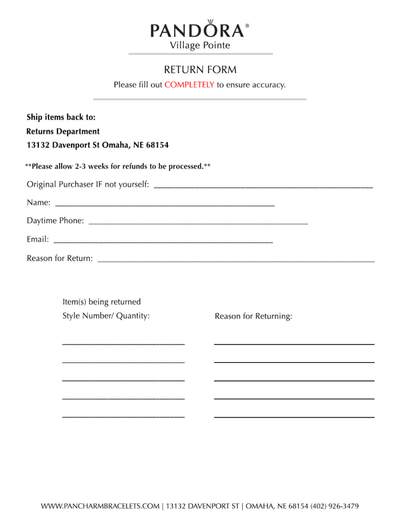

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.