Tax Documents

Cross-Border Taxation

Massachusetts Estimated Income Tax Payment Guidance

This document provides essential information about Massachusetts' estimated income tax payment process. It includes guidelines for various taxpayers, instructions for filling out the forms, and deadlines to keep in mind. Understanding these details can help you ensure compliance and avoid penalties.

Sales Tax

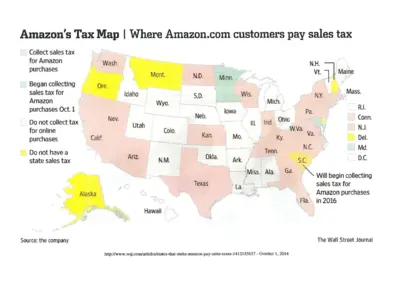

Amazon Sales Tax Map and Collection Details

This document provides a map of U.S. states where Amazon collects sales taxes and details the reasons for tax collection. It includes information on states with physical Amazon facilities, affiliate nexus laws, and states that will begin collecting taxes in the future. This is useful for understanding Amazon's tax obligations across states.

Cross-Border Taxation

Madhya Pradesh Commercial Tax Rules and Guidelines

This document outlines the Madhya Pradesh Commercial Tax Rules, 1995. It provides detailed instructions and definitions for taxpayers. Essential for understanding compliance in commercial taxation.

Income Verification

Landlord Verification Form Instructions and Details

The Landlord Verification Form is used to verify your residency and rent/utility expenses. It provides proof of residency for various benefits. Completing this form may help you receive more benefits.

Cross-Border Taxation

2023 Malaysia Private Sector Income Tax Form EA

This form is essential for employees in Malaysia to report their income tax details. It provides a comprehensive overview of remuneration and tax deductions for the financial year. Ensure to fill it out accurately for proper tax compliance.

Cross-Border Taxation

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

Cross-Border Taxation

Audit Report for Tamil Nadu VAT Compliance

This audit report is vital for businesses to comply with the Tamil Nadu Value Added Tax Act. It ensures accurate reporting of tax details. Complete the form to validate compliance and audit procedures.

Federal Tax Forms

COMPLAINT OF DISCRIMINATION IN THE FEDERAL GOVERNMENT

This file is used for filing complaints of discrimination within the federal government. It includes sections for contact information, details of the complaint, and additional information. It is essential for those who believe they have faced discrimination.

Cross-Border Taxation

Form 4868 U.S. Individual Income Tax Extension

Form 4868 allows taxpayers to apply for an automatic extension to file their U.S. individual income tax return. This form provides additional time to file without incurring penalties. Ensure to understand the details required to fill out the form accurately.

Cross-Border Taxation

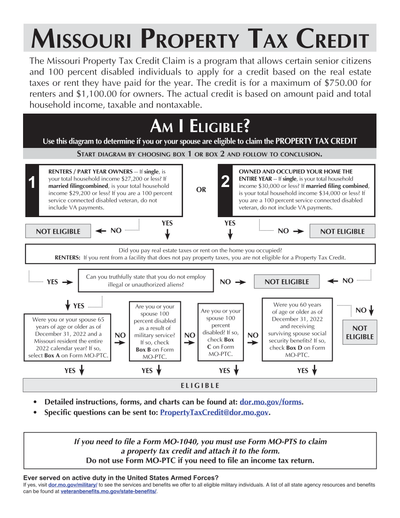

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

Gujarat Commercial Tax Dealer Registration and E-Services FAQs

This file contains FAQs regarding dealer registration, downloading certificates, submitting grievances, and making e-payments. It covers various e-services provided by the Gujarat Commercial Tax Department.

Tax Returns

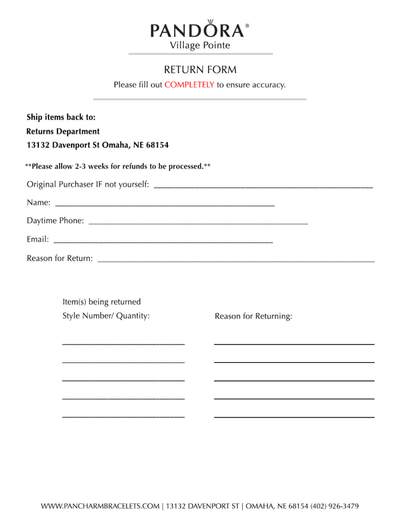

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.