Tax Documents

Cross-Border Taxation

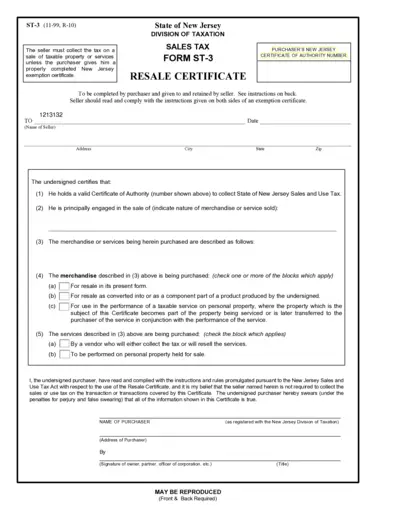

New Jersey Sales Tax Resale Certificate ST-3

The New Jersey Sales Tax Resale Certificate ST-3 is essential for sellers who need to collect sales tax. This form allows purchasers to claim tax exemptions for resale items. Proper completion ensures compliance with New Jersey tax regulations.

Cross-Border Taxation

Employer Identification Number Confirmation Guide

This document provides detailed instructions on how to obtain a confirmation letter (147C letter) for your EIN. It is essential for clergy and employees facing issues with E-Filing their tax returns due to EIN discrepancies. Follow the guidelines to ensure a smooth process in obtaining necessary confirmation from the IRS.

Cross-Border Taxation

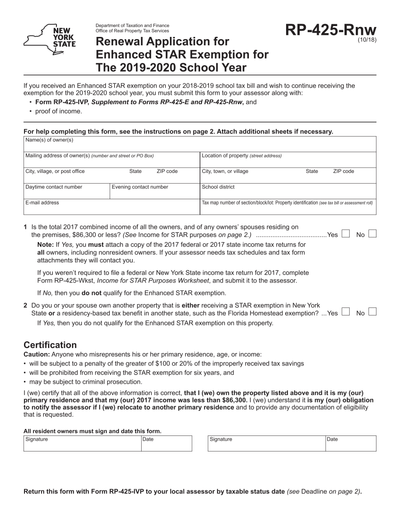

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

Income Verification

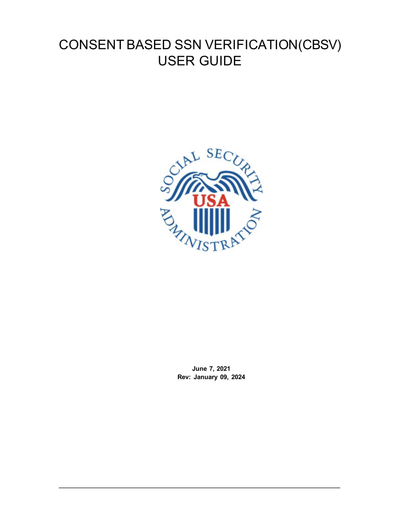

Consent Based SSN Verification User Guide

This guide provides detailed instructions on how to use the Consent Based SSN Verification (CBSV) service. It is essential for compliant SSN verification for businesses and individuals. Learn how to register, access, and manage CBSV effectively.

Cross-Border Taxation

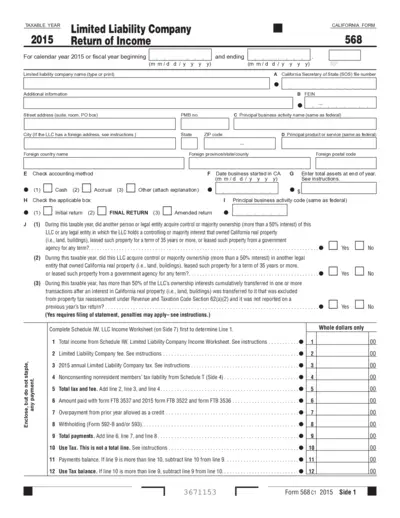

California Form 568 Limited Liability Company Tax Return

This form is essential for Limited Liability Companies in California to report their income and pay taxes. It includes various fields to capture business information and financial details. Ensure accurate completion to avoid penalties and ensure compliance.

Tax Returns

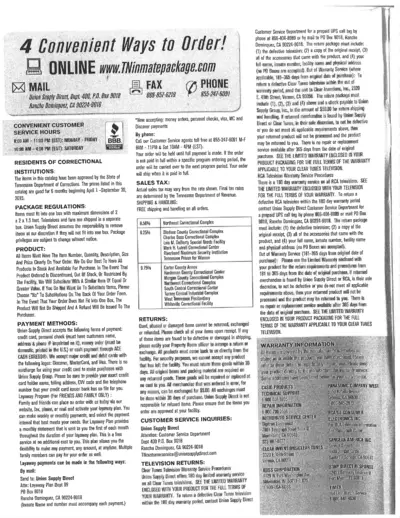

Instructions for Using Clear Tunes and RCA Returns

This document outlines the return procedures for Clear Tunes and RCA televisions. It specifies the necessary items for returning defective products. Follow these instructions carefully to ensure a smooth return process.

Cross-Border Taxation

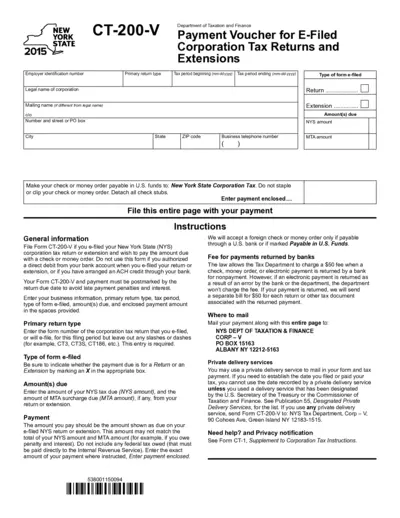

NY State Corporation Tax Payment Voucher 2015

The CT-200-V form is a payment voucher for e-filed New York State corporation tax returns and extensions. It is used to submit payments through checks or money orders. Ensure timely submission to avoid penalties.

Tax Returns

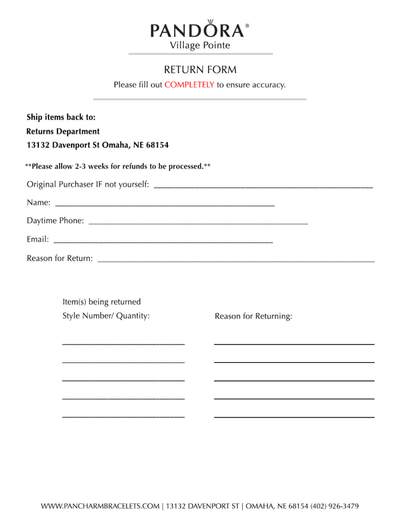

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Federal Tax Forms

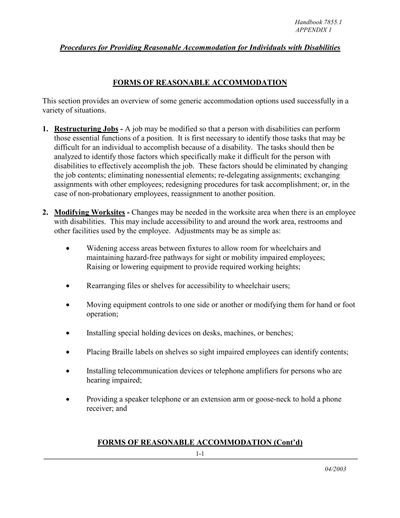

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

Payroll Tax

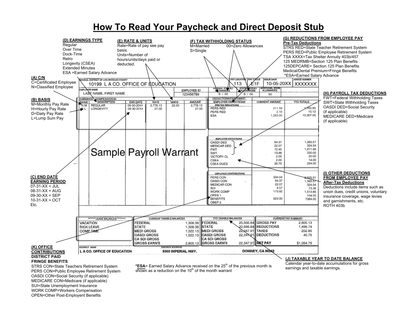

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

Cross-Border Taxation

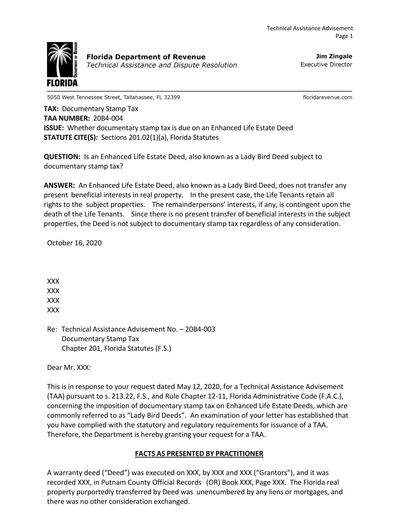

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Income Verification

Attestation Statement for SSA Form 89 Verification

This file contains the attestation statement for using the SSA Form 89 Verification Service. It includes the rules and requirements for accessing the CBSV service. Additionally, it outlines the responsibilities for safeguarding Personal Identifiable Information (PII).