Tax Documents

Tax Returns

UNIQLO Online Return Form and Policy Guidance

This file contains the essential details and instructions for returning items to UNIQLO. Users will find step-by-step guidance and necessary forms for a smooth return process. It ensures customers know how to initiate a return and the policies regarding refunds.

Tax Returns

BIS Return Merchandise Authorization Form Guidelines

This document provides detailed information for the BIS Return Merchandise Authorization process. It includes customer information, return shipping options, and instructions for filling out the form. Follow the guidelines to ensure a smooth return process.

Cross-Border Taxation

Madhya Pradesh Commercial Tax Rules and Guidelines

This document outlines the Madhya Pradesh Commercial Tax Rules, 1995. It provides detailed instructions and definitions for taxpayers. Essential for understanding compliance in commercial taxation.

Cross-Border Taxation

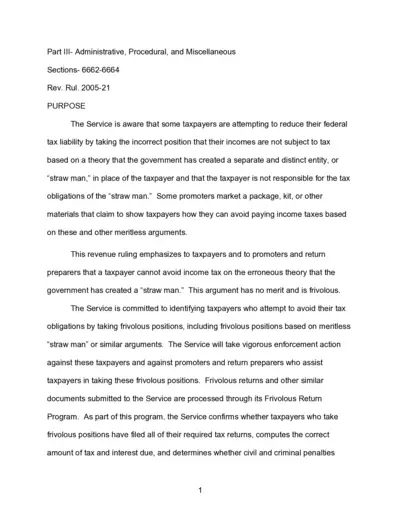

Understanding the Straw Man Theory and Tax Obligations

This file provides essential information about the 'straw man' theory and its relationship with federal tax obligations. It outlines the consequences for taxpayers who attempt to avoid taxes using erroneous claims. It serves as a guide for taxpayers to understand their responsibilities regarding tax submissions.

Income Verification

Consent Based SSN Verification User Guide

This guide provides detailed instructions on how to use the Consent Based SSN Verification (CBSV) service. It is essential for compliant SSN verification for businesses and individuals. Learn how to register, access, and manage CBSV effectively.

Cross-Border Taxation

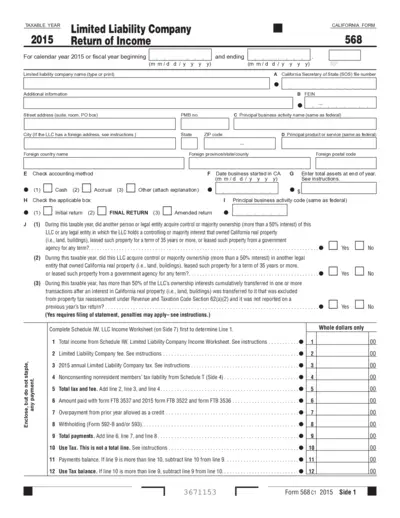

California Form 568 Limited Liability Company Tax Return

This form is essential for Limited Liability Companies in California to report their income and pay taxes. It includes various fields to capture business information and financial details. Ensure accurate completion to avoid penalties and ensure compliance.

Tax Returns

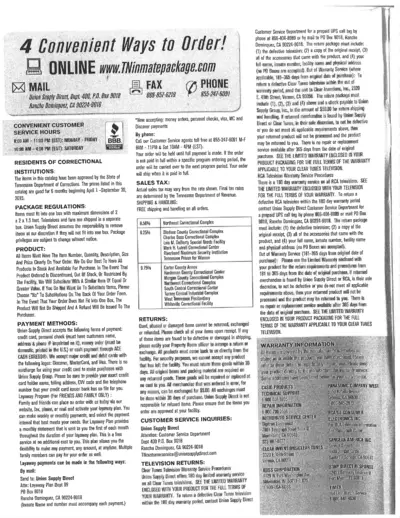

Instructions for Using Clear Tunes and RCA Returns

This document outlines the return procedures for Clear Tunes and RCA televisions. It specifies the necessary items for returning defective products. Follow these instructions carefully to ensure a smooth return process.

Cross-Border Taxation

Certificate of Update of Exemption and Employee Info

This file is a certificate used for updating exemption and employee information for the Bureau of Internal Revenue. It is essential for employees and self-employed individuals to accurately report their tax-exempt status. Proper completion of this form ensures compliance with Philippine tax regulations.

Tax Returns

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Federal Tax Forms

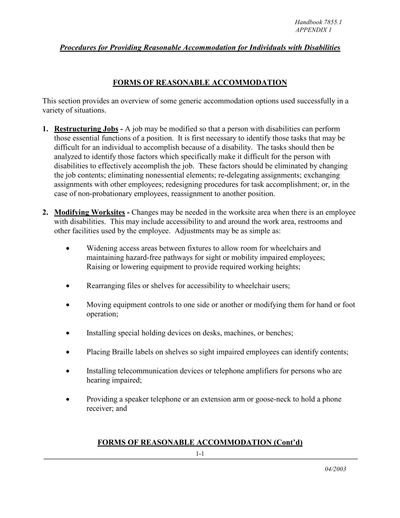

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

Payroll Tax

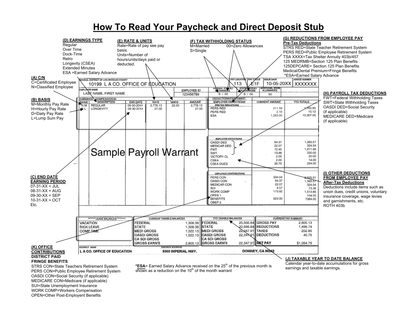

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

Cross-Border Taxation

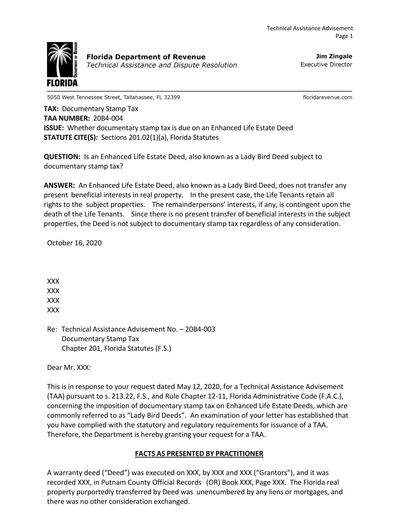

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.