Tax Documents

Cross-Border Taxation

Instructions for Form CT-5 Request for Extension

This file provides detailed instructions for completing Form CT-5 to request a six-month extension for filing taxes in New York. It is essential for corporations seeking to extend their filing deadlines while ensuring compliance with tax laws. The guidelines include eligibility criteria, required forms, and submission instructions.

Cross-Border Taxation

Registering for Self Assessment and Tax Returns

This file contains essential information on registering for Self Assessment in the UK, including the steps to acquire a Unique Taxpayer Reference (UTR). It guides users through filling out a tax return form accurately and adhering to necessary tax regulations. Ideal for both individuals and businesses, the document simplifies tax obligations and ensures compliance with HMRC requirements.

Cross-Border Taxation

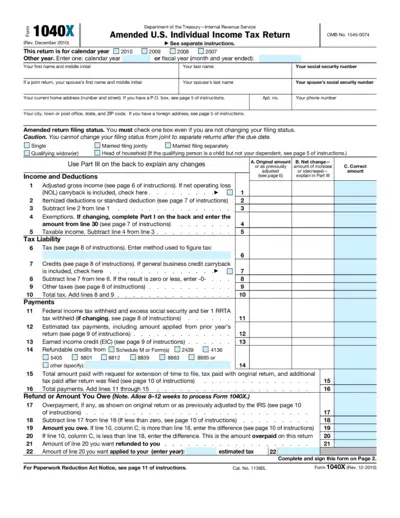

Amended U.S. Individual Income Tax Return (Form 1040X)

Form 1040X is the Amended U.S. Individual Income Tax Return for correcting your previously filed tax return. This form allows taxpayers to make changes to their filing status, income, deductions, or credits. It's essential for ensuring your tax records are accurate and up to date.

Cross-Border Taxation

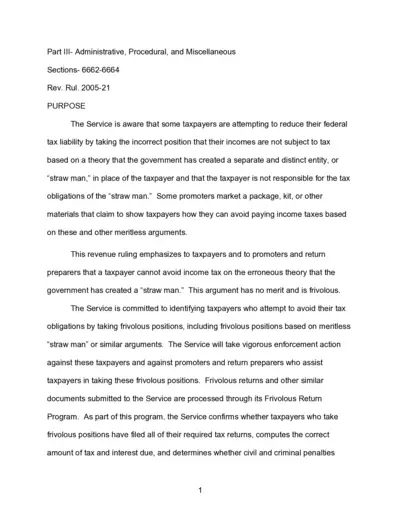

Understanding the Straw Man Theory and Tax Obligations

This file provides essential information about the 'straw man' theory and its relationship with federal tax obligations. It outlines the consequences for taxpayers who attempt to avoid taxes using erroneous claims. It serves as a guide for taxpayers to understand their responsibilities regarding tax submissions.

Income Verification

Consent Based SSN Verification User Guide

This guide provides detailed instructions on how to use the Consent Based SSN Verification (CBSV) service. It is essential for compliant SSN verification for businesses and individuals. Learn how to register, access, and manage CBSV effectively.

Cross-Border Taxation

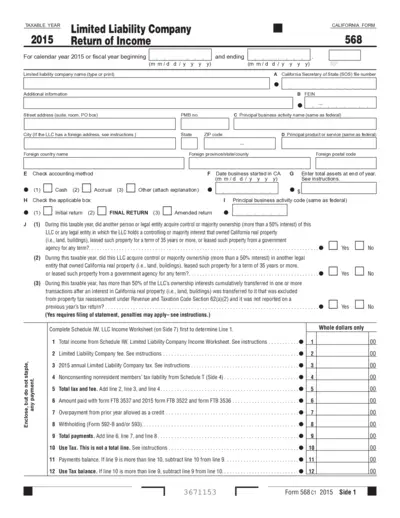

California Form 568 Limited Liability Company Tax Return

This form is essential for Limited Liability Companies in California to report their income and pay taxes. It includes various fields to capture business information and financial details. Ensure accurate completion to avoid penalties and ensure compliance.

Tax Returns

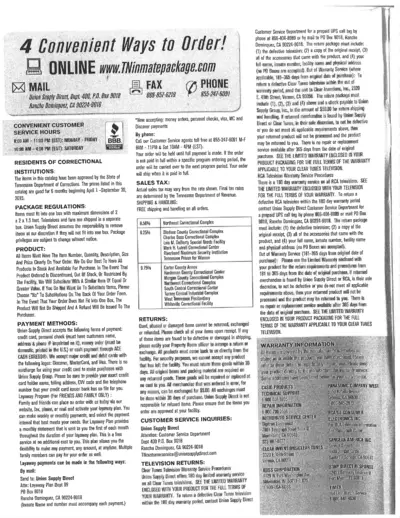

Instructions for Using Clear Tunes and RCA Returns

This document outlines the return procedures for Clear Tunes and RCA televisions. It specifies the necessary items for returning defective products. Follow these instructions carefully to ensure a smooth return process.

Cross-Border Taxation

Updated 2013 Alaska Corporate Partnership Tax Forms

This document provides essential information about the updated corporate and partnership forms released by the Alaska Department of Revenue for tax year 2013. It includes important instructions and form renumbering details. Taxpayers should refer to these drafts for accurate tax filing.

Tax Returns

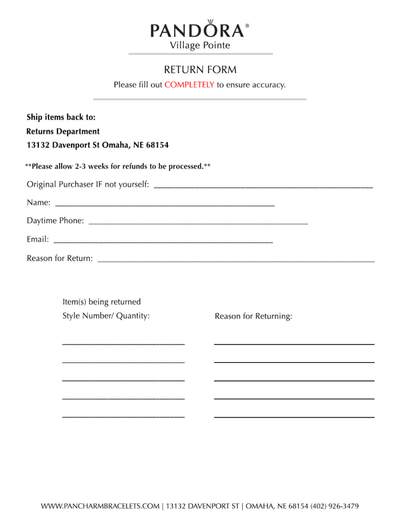

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Federal Tax Forms

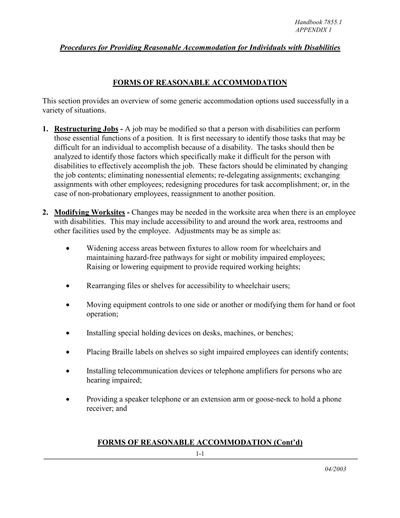

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.

Payroll Tax

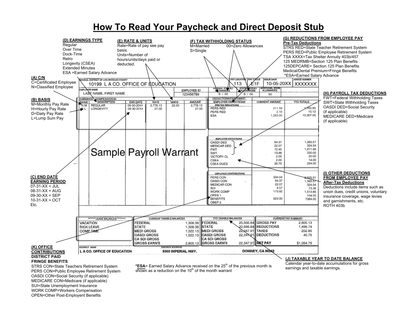

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

Cross-Border Taxation

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.