Tax Documents

Payroll Tax

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

Cross-Border Taxation

2014 Tax Preparer's Guide for Income Tax Returns

This guide provides crucial information for tax preparers and electronic return originators in New Mexico. It offers instructions and updates to help users efficiently file 2014 income tax returns. Tax practitioners will find the latest requirements and deadlines essential for compliance.

Tax Returns

Solas Ray Lighting RMA Request Form Submission

This file is a Return Merchandise Authorization (RMA) form for Solas Ray Lighting. Users must fill out this form to return products for repair or credit. Detailed instructions for filling out the form are included within.

Cross-Border Taxation

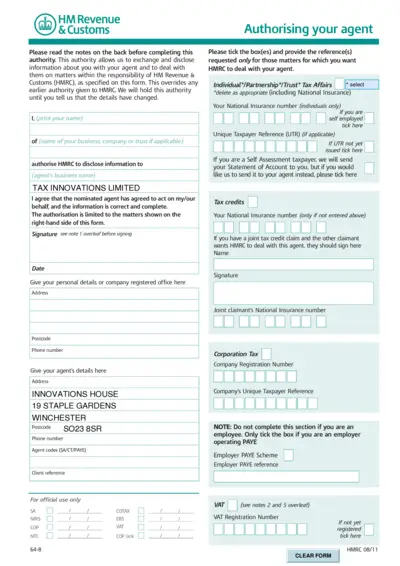

HMRC Agent Authorisation Form Submission

This file is the HM Revenue and Customs (HMRC) Agent Authorisation Form. It allows individuals and businesses to authorize their agents to act on their behalf regarding tax affairs. Proper completion ensures efficient management of your tax-related matters.

Tax Returns

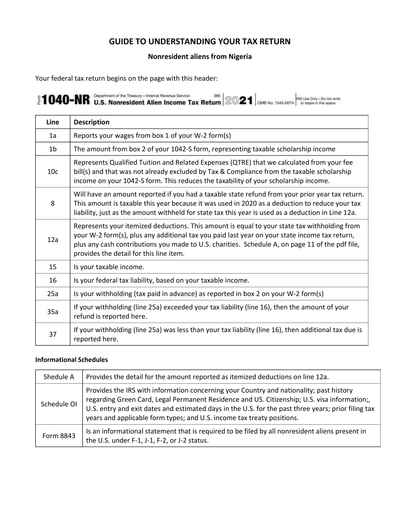

Guide to Understanding Your Tax Return

This file provides detailed explanations of the U.S. nonresident alien income tax return and Connecticut resident tax return. It outlines the requirements and instructions for completing forms 1040-NR and CT-1040. Ideal for nonresident aliens from Nigeria and Connecticut residents.

Cross-Border Taxation

Guidelines for Filing Form T-2 in Delhi

This document outlines the procedure and requirements for filing Form T-2 in Delhi. It is essential for all registered dealers to understand the filing process, including exceptions and special cases. The FAQs provided will help clarify common queries regarding this form.

Cross-Border Taxation

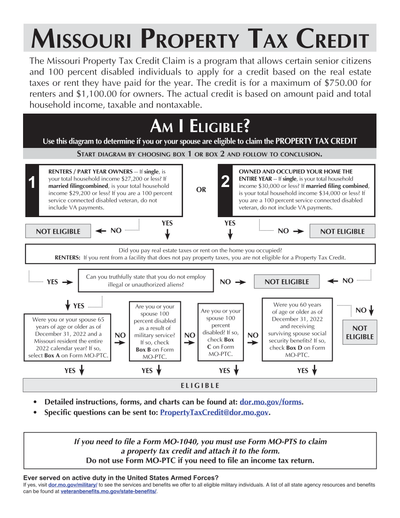

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

Virginia Automatic Extension Payment Form 760IP

The 2016 Virginia Form 760IP is used for automatic extension payments for individuals. This form allows you to file and pay your tentative tax online easily. Avoid penalties and interest by submitting your payment by the due date.

Income Verification

Consent Based SSN Verification User Guide

This guide provides detailed instructions on how to use the Consent Based SSN Verification (CBSV) service. It is essential for compliant SSN verification for businesses and individuals. Learn how to register, access, and manage CBSV effectively.

Cross-Border Taxation

URA Simplifies TIN Registration Process

The Uganda Revenue Authority has launched a simplified web-based TIN registration process. This new system enhances user experience and expedites application procedures. Individuals can now apply for their Tax Identification Number conveniently online.

Tax Returns

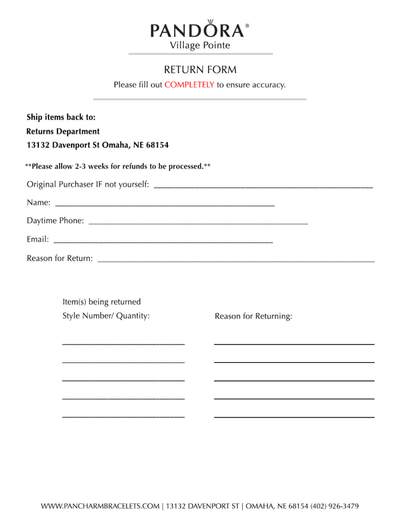

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Federal Tax Forms

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.