Tax Documents

State Tax Forms

Illinois Schedule K-1-P Instructions for 2023

This document provides comprehensive instructions for Schedule K-1-P, which reflects your share of income, modifications, and credits from partnerships or S corporations. It includes essential information for both residents and non-residents of Illinois. Use this guide to ensure accurate completion of your Illinois income tax return.

Tax Returns

Reebok and Rockport Returns & Instructions

This file outlines the return policy and fitting instructions for Reebok and Rockport footwear. It guides users through the return process and provides important contact information. Perfect for customers looking to return their shoes or find fitting tips.

Cross-Border Taxation

Nebraska Estimated Income Tax Payment Instructions

This file provides essential information on estimated income tax payments for Nebraska residents and nonresidents. It includes instructions on payment deadlines and methods, as well as eligibility criteria for required payments. Utilize this guide to ensure compliance with Nebraska tax regulations.

Tax Residency

Understanding Residency and Legal Residence for Military

This document provides key insights about residence and legal residence for military members. It outlines essential information about domicile and related processes. Ideal for service members seeking clarity on residency regulations.

Payroll Tax

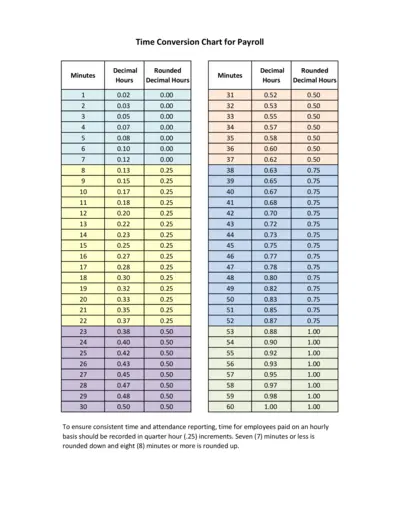

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

Cross-Border Taxation

Guidelines for Filing Form T-2 in Delhi

This document outlines the procedure and requirements for filing Form T-2 in Delhi. It is essential for all registered dealers to understand the filing process, including exceptions and special cases. The FAQs provided will help clarify common queries regarding this form.

Cross-Border Taxation

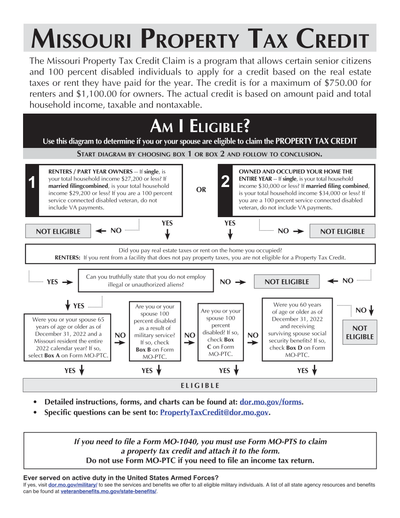

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

Virginia Automatic Extension Payment Form 760IP

The 2016 Virginia Form 760IP is used for automatic extension payments for individuals. This form allows you to file and pay your tentative tax online easily. Avoid penalties and interest by submitting your payment by the due date.

Income Verification

Consent Based SSN Verification User Guide

This guide provides detailed instructions on how to use the Consent Based SSN Verification (CBSV) service. It is essential for compliant SSN verification for businesses and individuals. Learn how to register, access, and manage CBSV effectively.

Cross-Border Taxation

Instructions for Form FT-500 Application for Refund

This document provides detailed instructions for the Form FT-500, which is used to apply for refunds of sales tax paid on petroleum products in New York State.

Tax Returns

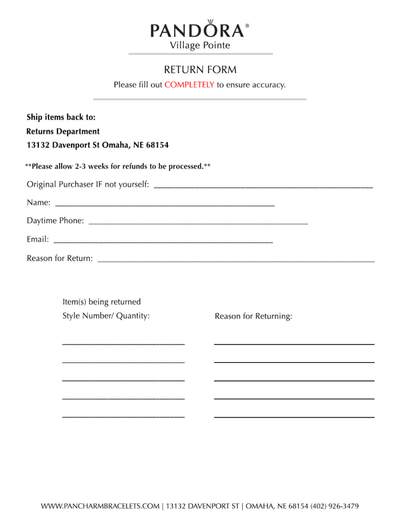

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Federal Tax Forms

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.