Tax Documents

Cross-Border Taxation

New Jersey Beverage Tax Inventory Record Form

This file is the R-40 (04-16) form used by the New Jersey Department of the Treasury, Division of Taxation. It is used by licensed distillers, rectifiers, and blenders to record transactions and operations affecting the inventory of federal-tax paid stock. This includes inventory on licensed manufacturing premises or in federal-tax paid sections of licensed public warehouses.

Cross-Border Taxation

2021 Rhode Island Form RI-1040H Property Tax Relief

The 2021 Form RI-1040H is a tax relief claim for Rhode Island residents. It allows eligible individuals to apply for property tax relief based on their income and age or disability status. Make sure to follow the instructions carefully to ensure proper submission.

Cross-Border Taxation

2023 Personal Tax Credits Return TD1 for Canada

The 2023 Personal Tax Credits Return (TD1) is essential for Canadians to specify tax deductions and credits accurately. This form helps determine how much tax is deducted from your pay. It contains various fields to report personal amounts and caregiving credits.

Cross-Border Taxation

Millions of Dollars in FIRPTA Tax Withholding Discrepancies

This report highlights significant discrepancies in tax withholding required by the Foreign Investment in Real Property Tax Act. It assesses IRS efforts in verifying withholding credits and identifies areas needing improvement. The findings and recommendations aim to enhance compliance and accuracy in tax reporting.

Cross-Border Taxation

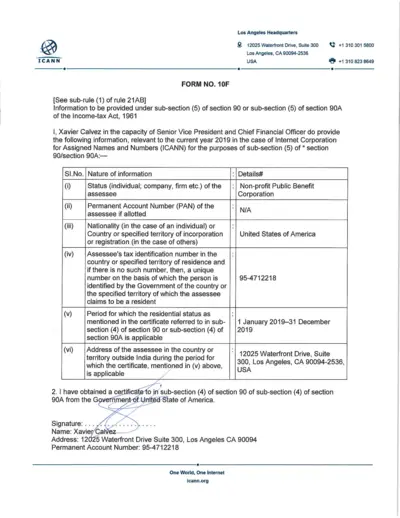

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

Cross-Border Taxation

Guidelines for Filing Form T-2 in Delhi

This document outlines the procedure and requirements for filing Form T-2 in Delhi. It is essential for all registered dealers to understand the filing process, including exceptions and special cases. The FAQs provided will help clarify common queries regarding this form.

Cross-Border Taxation

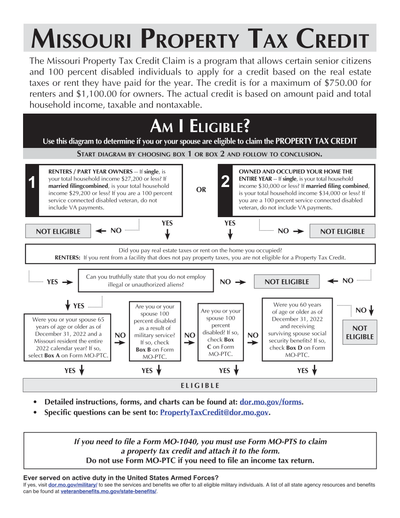

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

Virginia Automatic Extension Payment Form 760IP

The 2016 Virginia Form 760IP is used for automatic extension payments for individuals. This form allows you to file and pay your tentative tax online easily. Avoid penalties and interest by submitting your payment by the due date.

Income Verification

Consent Based SSN Verification User Guide

This guide provides detailed instructions on how to use the Consent Based SSN Verification (CBSV) service. It is essential for compliant SSN verification for businesses and individuals. Learn how to register, access, and manage CBSV effectively.

Tax Credits

2023 Renters Tax Credit Application Maryland

The Maryland Renters' Tax Credit Application helps qualified renters receive financial assistance. Complete this form to claim your tax credit. Ensure you meet the eligibility requirements before applying.

Tax Returns

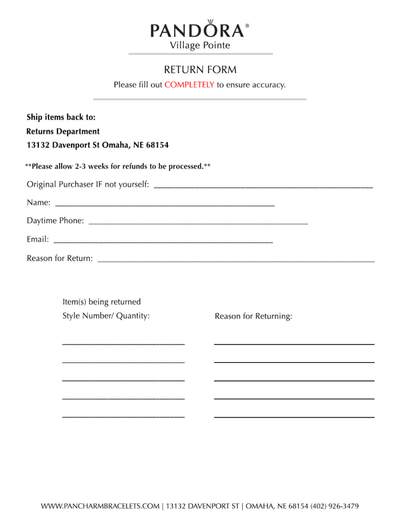

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

Federal Tax Forms

Procedures for Providing Reasonable Accommodation

This file outlines procedures for providing reasonable accommodation to individuals with disabilities. It includes various forms of reasonable accommodation such as job restructuring, modifying worksites, accessible facilities, adjusting work schedules, and flexible leave policies. The file is meant for Federal agencies to ensure compliance with the Rehabilitation Act of 1973.