Tax Documents

Cross-Border Taxation

URA Simplifies TIN Registration Process

The Uganda Revenue Authority has launched a simplified web-based TIN registration process. This new system enhances user experience and expedites application procedures. Individuals can now apply for their Tax Identification Number conveniently online.

Tax Returns

Return for Credit Form - Unitron Product Returns

The Return for Credit Form is used for customers to return Unitron products. It captures customer information, reason for return, and details about the instruments being returned. Follow the instructions to ensure your return is processed smoothly.

Cross-Border Taxation

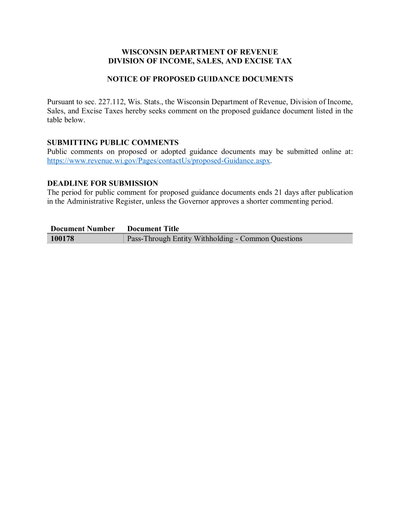

Wisconsin Pass-Through Entity Tax Guidance Document

This file provides essential guidance on Wisconsin's Pass-Through Entity withholding requirements. It outlines who needs to file, how to pay withholding taxes, and addresses common questions. Business owners and tax professionals will find this document invaluable for compliance and understanding tax obligations.

Cross-Border Taxation

Claim Refund After Deceased Taxpayer Form Instructions

This document provides detailed instructions for claiming a tax refund due to a deceased taxpayer. It guides users through the process of completing Form 1310 effectively. Ensure compliance with IRS requirements by following this comprehensive guide.

Cross-Border Taxation

Guide on Timely Tax Filing and Compliance

This document provides essential information regarding timely tax filing with the BIR. It includes important changes in tax return forms and deadlines. Ideal for taxpayers wanting to stay compliant with tax regulations.

Cross-Border Taxation

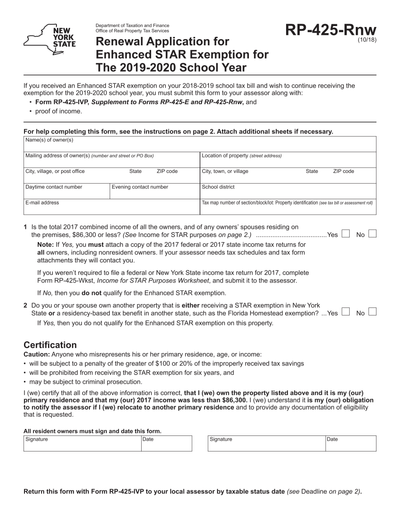

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

Cross-Border Taxation

Motor Vehicle Tax Manual Comprehensive Guide

The Motor Vehicle Tax Manual provides essential information and guidelines for understanding motor vehicle tax regulations in Texas. It includes various chapters on exemptions, auditing, and specific situations related to motor vehicle taxes. This manual is a valuable resource for tax assessors, dealers, and individuals involved in motor vehicle transactions.

Federal Tax Forms

COMPLAINT OF DISCRIMINATION IN THE FEDERAL GOVERNMENT

This file is used for filing complaints of discrimination within the federal government. It includes sections for contact information, details of the complaint, and additional information. It is essential for those who believe they have faced discrimination.

Cross-Border Taxation

Form 4868 U.S. Individual Income Tax Extension

Form 4868 allows taxpayers to apply for an automatic extension to file their U.S. individual income tax return. This form provides additional time to file without incurring penalties. Ensure to understand the details required to fill out the form accurately.

Cross-Border Taxation

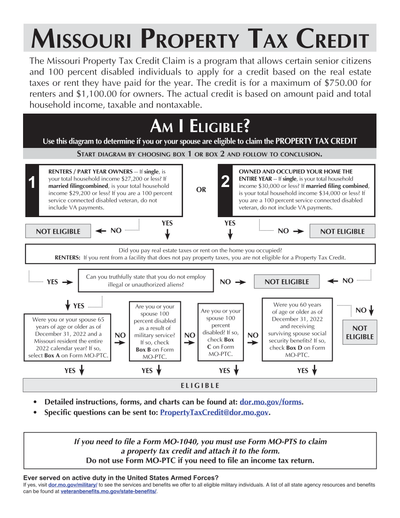

Missouri Property Tax Credit Application Guide

This file details the Missouri Property Tax Credit program, providing information on eligibility, how to apply, and instructions for completing the application. It is specifically designed for senior citizens and 100% disabled individuals to claim their property tax credits. For further assistance, users can find contact information and resources directly related to the program.

Cross-Border Taxation

Audit Report for Tamil Nadu VAT Compliance

This audit report is vital for businesses to comply with the Tamil Nadu Value Added Tax Act. It ensures accurate reporting of tax details. Complete the form to validate compliance and audit procedures.

Tax Returns

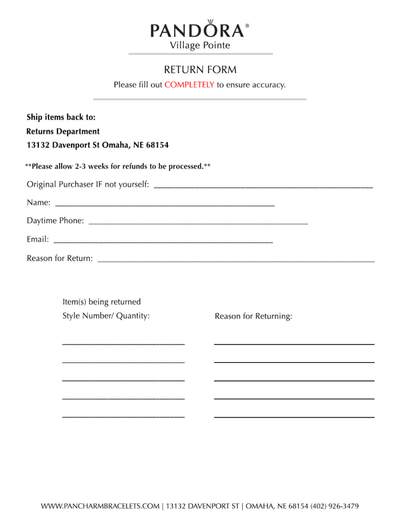

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.