Cross-Border Taxation Documents

Cross-Border Taxation

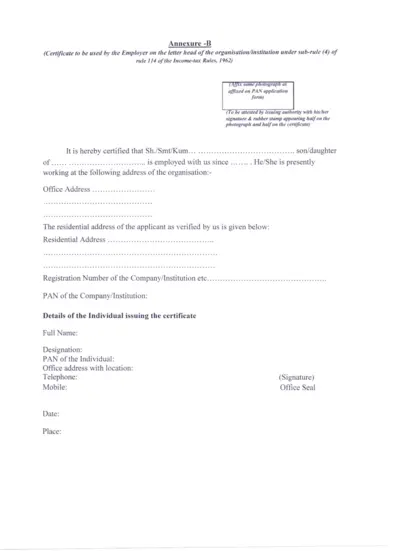

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

Cross-Border Taxation

Massachusetts Withholding by Pass-Through Entities Guide

This file provides essential information regarding Massachusetts withholding tax obligations for pass-through entities. It outlines exemptions, necessary forms, and compliance requirements. Businesses and individuals involved with pass-through entities will benefit from understanding these regulations.

Cross-Border Taxation

New Mexico Nontaxable Transaction Certificates Application

This application allows New Mexico buyers to obtain Nontaxable Transaction Certificates (NTTCs). Users can register with the Tax Department and submit applications. Follow the guidelines to complete the process correctly.

Cross-Border Taxation

Virginia Automatic Extension Payment Form 760IP

The 2016 Virginia Form 760IP is used for automatic extension payments for individuals. This form allows you to file and pay your tentative tax online easily. Avoid penalties and interest by submitting your payment by the due date.

Cross-Border Taxation

New York State Exempt Organization Certification

This document is the New York State Exempt Organization Certification form. It certifies that an organization is exempt from state and local sales and compensating use taxes. This certification must be filled out completely to be valid.

Cross-Border Taxation

New York Cigarette License Application Checklist

This file contains essential information and instructions for submitting the CG-100-C application for cigarette licensing in New York State. It outlines the necessary forms, fees, and documents required to complete your application. Understanding these details will ensure a smooth application process.

Cross-Border Taxation

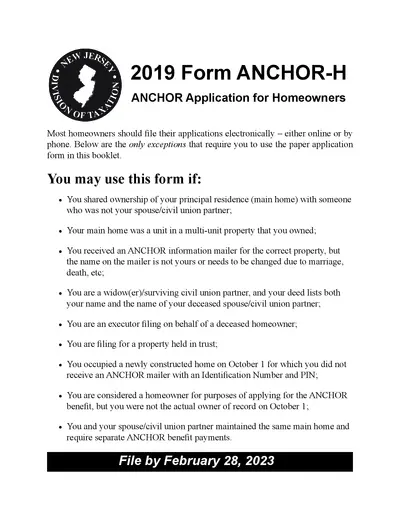

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Cross-Border Taxation

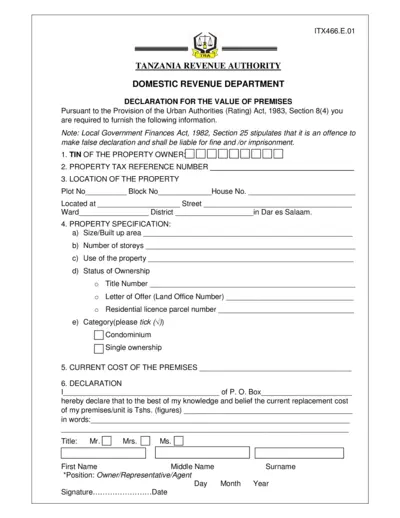

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

Cross-Border Taxation

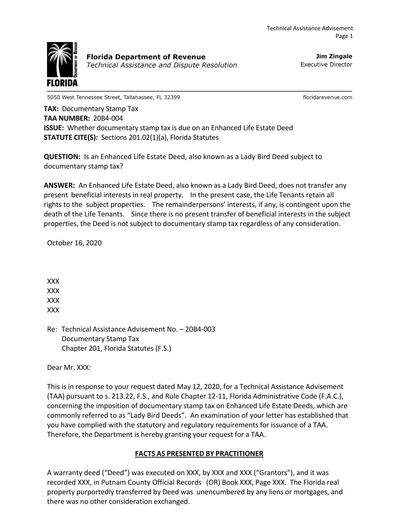

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Cross-Border Taxation

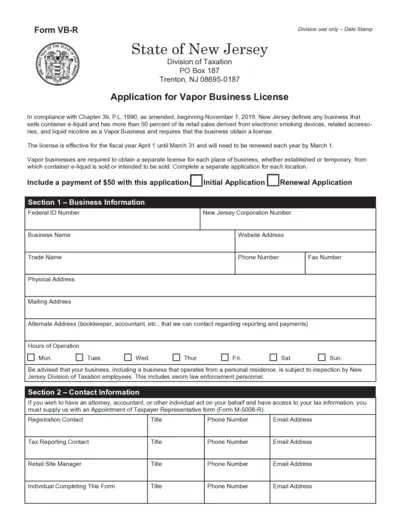

New Jersey Vapor Business License Application

This file is an application for a New Jersey Vapor Business License. It includes various sections for business information, contact details, ownership details, and types of products sold. It must be completed and submitted with a $50 payment.

Cross-Border Taxation

Form 4868 U.S. Individual Income Tax Extension

Form 4868 allows taxpayers to apply for an automatic extension to file their U.S. individual income tax return. This form provides additional time to file without incurring penalties. Ensure to understand the details required to fill out the form accurately.

Cross-Border Taxation

Guyana Taxpayer Identification Number Application

This file contains the application form for obtaining a Taxpayer Identification Number (TIN) in Guyana. It includes detailed instructions for individual applicants. Proper completion of the form is essential for successful registration.