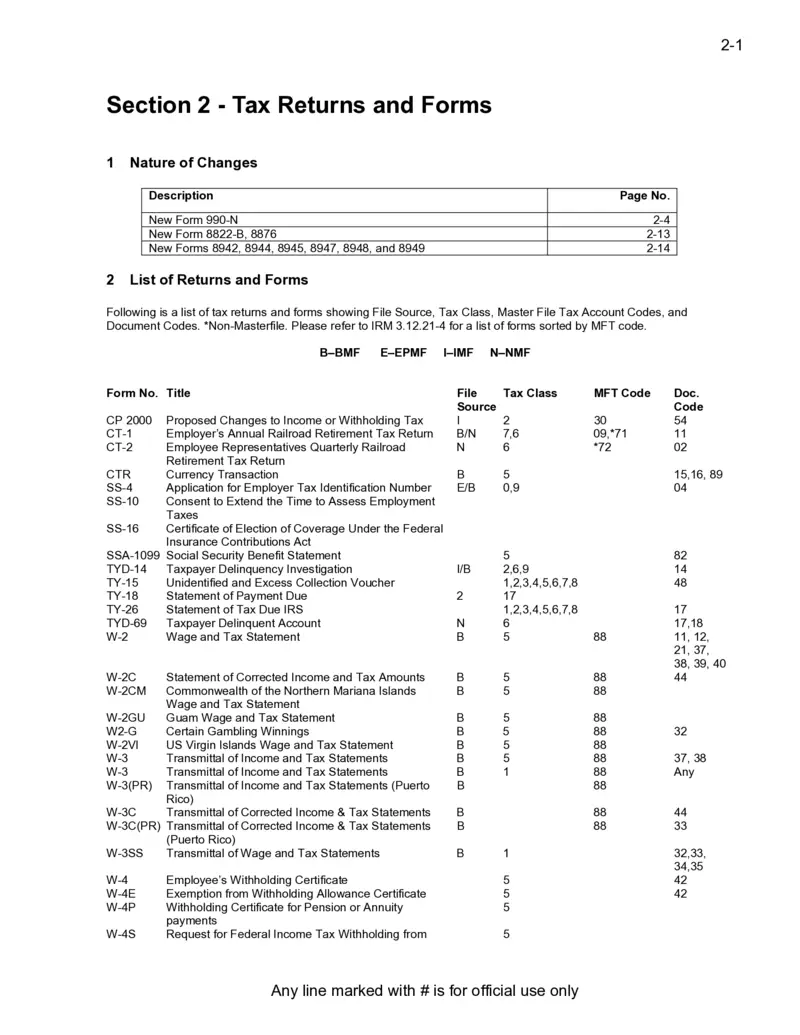

Tax Returns and Forms Overview 2024

This file contains critical information on various tax returns and forms required for compliance in 2024. It provides detailed descriptions of new forms and changes to existing ones. Users can refer to this file for understanding the necessary documentation for tax filing.

Edit, Download, and Sign the Tax Returns and Forms Overview 2024

Form

eSign

Add Annotation

Share Form

How do I fill this out?

To fill this form, start by gathering all relevant information regarding your financial status and previous tax returns. Next, carefully read the instructions associated with each section of the form to ensure accurate completion. Finally, review your entries for errors and submit the form as instructed.

How to fill out the Tax Returns and Forms Overview 2024?

1

Gather necessary financial documents.

2

Read instructions thoroughly.

3

Complete each section accurately.

4

Double-check your entries for errors.

5

Submit the form following the provided guidelines.

Who needs the Tax Returns and Forms Overview 2024?

1

Individuals filing personal tax returns.

2

Businesses needing to report employee wages.

3

Non-profits applying for tax-exempt status.

4

Estate administrators managing estate taxes.

5

Tax professionals preparing client filings.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the Tax Returns and Forms Overview 2024 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your Tax Returns and Forms Overview 2024 online.

Editing PDFs on PrintFriendly is simple and efficient. You can select any text field to make changes and ensure your document is accurate. Our PDF editor allows for easy adjustments to the layout and content of your forms.

Add your legally-binding signature.

Signing your PDF on PrintFriendly is now a hassle-free process. You can add your signature with a simple click, ensuring your document is officially recognized. This feature keeps your workflow efficient and seamless.

Share your form instantly.

Sharing your PDF is straightforward with PrintFriendly. Once your document is ready, you can easily send it via email or share it through social media. Our platform ensures your files are shareable with just a few clicks.

How do I edit the Tax Returns and Forms Overview 2024 online?

Editing PDFs on PrintFriendly is simple and efficient. You can select any text field to make changes and ensure your document is accurate. Our PDF editor allows for easy adjustments to the layout and content of your forms.

1

Open the PDF file in PrintFriendly.

2

Select the sections you want to edit.

3

Make changes directly in the PDF.

4

Review all edits for correctness.

5

Save or download your edited document.

What are the instructions for submitting this form?

Submit this form electronically via the IRS e-file system or mail it to the following address: IRS, P.O. Box 123, Anytown, USA 45678. Ensure you include any necessary attachments and send the form well before the deadline. For guidance, always check the IRS website for the latest submission procedures.

What are the important dates for this form in 2024 and 2025?

Key dates for tax filing include April 15, 2024, for individual returns and July 15, 2024, for extensions. Businesses must file quarterly returns on specific due dates according to their classification. Mark these dates on your calendar to avoid late penalties.

What is the purpose of this form?

This form is designed to facilitate the collection and reporting of various tax obligations for individuals and organizations in the United States. It provides a structured format to ensure all necessary information is captured accurately. Compliance with tax regulations is critical, making this form essential in the filing process.

Tell me about this form and its components and fields line-by-line.

- 1. Taxpayer Identification Number: Unique identifier assigned to individuals and businesses for tax purposes.

- 2. Income Details: Information regarding all forms of income to be reported on tax returns.

- 3. Deductions: Fields for entering eligible deductions to reduce taxable income.

- 4. Signature Line: Area for the taxpayer to sign confirming the accuracy of the information provided.

- 5. Submission Instructions: Guidelines on how and where to submit the completed form.

What happens if I fail to submit this form?

Failing to submit this form can result in severe penalties, including fines and interest on unpaid taxes. Additionally, delays in processing your tax return may occur, leading to further financial ramifications. It is crucial to adhere to submission deadlines to avoid complications.

- Financial Penalties: Late submissions can lead to increased fines and interest accumulating over time.

- Delayed Refunds: Failure to file on time may postpone tax return refunds, affecting personal finances.

- Legal Consequences: Not filing can result in legal actions undertaken by the IRS against the taxpayer.

How do I know when to use this form?

- 1. Annual Tax Filing: Mandatory for individuals and businesses when filing annual tax returns.

- 2. Amendments: Required for making corrections to past tax submissions.

- 3. Claim Deductions: Necessary for claiming tax deductions and credits to reduce tax liability.

Frequently Asked Questions

How do I edit this PDF?

To edit the PDF, open the file in PrintFriendly and select the text fields you wish to modify.

Can I download the PDF after editing?

Yes, after making your changes, you can download the edited PDF directly.

What types of files can I edit?

You can edit any PDF file that you upload to PrintFriendly.

Is there a limit to the number of edits?

No, you can make as many edits as you need before downloading.

Can I share my edited PDF?

Absolutely! You can share your PDF via email or social media links.

Do I need an account to edit PDFs?

No account is needed; you can start editing as soon as you upload your PDF.

How do I sign a PDF?

To sign, simply click on the signature field and follow the instructions to add your signature.

Can I undo changes in my PDF?

Yes, you can easily revert changes before finalizing your document.

What if I encounter an error while editing?

If there’s an error, just refresh the page and try again with your PDF.

Is PrintFriendly free to use?

Yes, you can edit and download PDFs for free on PrintFriendly.