International Tax Documents

Cross-Border Taxation

Tax-Exempt Status for Your Organization

This publication provides essential information about applying for tax-exempt status under the Internal Revenue Code. It outlines application procedures, filing requirements, and details pertinent to various exempt organizations. Use this guide to navigate the complexities of tax exemption applications effectively.

Cross-Border Taxation

Withholding Requirements for Nonresident Property Transfer

This file provides important information regarding income tax withholding on real property sales by nonresidents in Georgia. It outlines the relevant Georgia code and applicable exemptions. This is essential for sellers and buyers in understanding their tax obligations.

Cross-Border Taxation

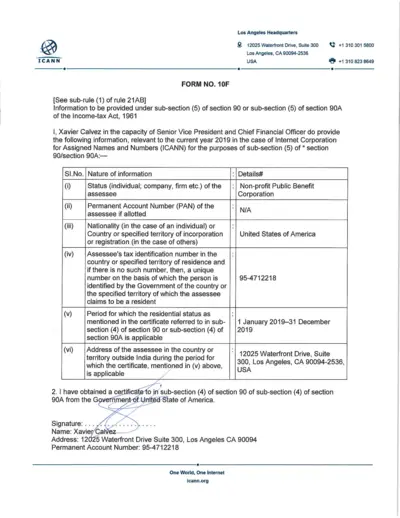

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

Cross-Border Taxation

IRS 2023 Publication 596 Earned Income Credit Guidelines

This publication provides comprehensive guidance on the Earned Income Credit (EIC) for the tax year 2023. It outlines eligibility requirements, tax benefits, and instructions for claiming the EIC. Suitable for taxpayers seeking to maximize their tax benefits and ensure compliance with IRS rules.

Cross-Border Taxation

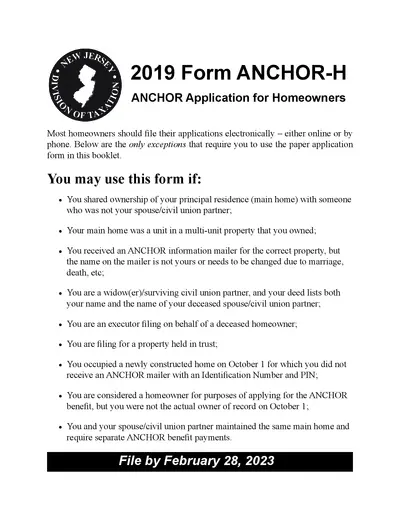

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Cross-Border Taxation

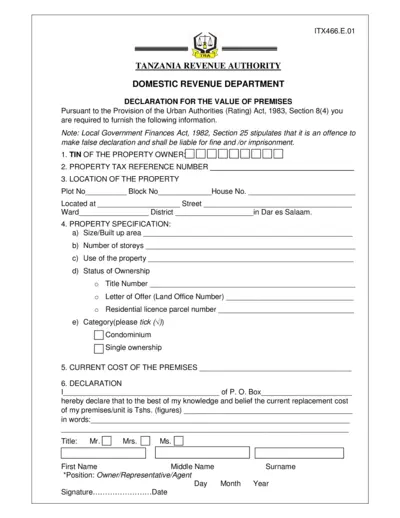

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

Cross-Border Taxation

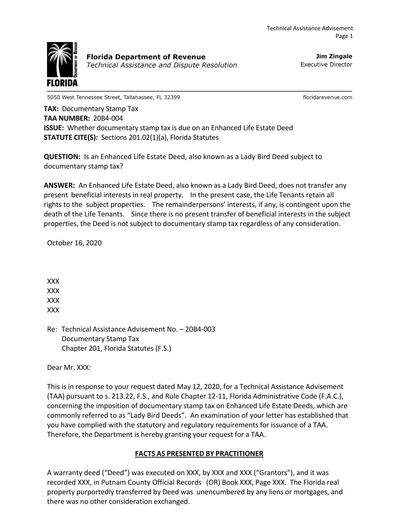

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Cross-Border Taxation

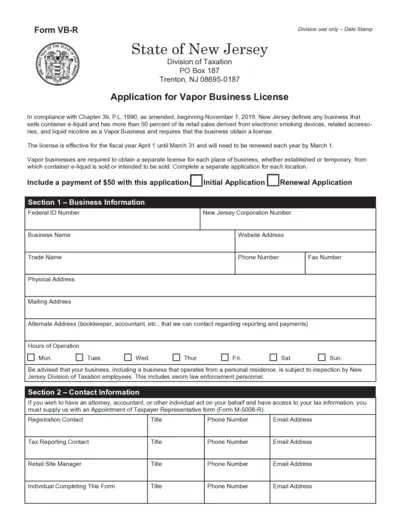

New Jersey Vapor Business License Application

This file is an application for a New Jersey Vapor Business License. It includes various sections for business information, contact details, ownership details, and types of products sold. It must be completed and submitted with a $50 payment.

Cross-Border Taxation

Audit Report for Tamil Nadu VAT Compliance

This audit report is vital for businesses to comply with the Tamil Nadu Value Added Tax Act. It ensures accurate reporting of tax details. Complete the form to validate compliance and audit procedures.

Cross-Border Taxation

Application for Registration - BIR Form 1904

This file contains the application form for registration with the Bureau of Internal Revenue in the Philippines. It includes essential details for both individuals and non-individuals applying for a Tax Identification Number (TIN). Use this document to ensure compliance with tax regulations.

Cross-Border Taxation

New York City Parking Tax Exemption for Residents

This document provides detailed information on the New York City Parking Tax Exemption for Manhattan residents. It outlines criteria, procedures, and eligibility requirements for obtaining the exemption. It is crucial for residents seeking tax relief on parking services within Manhattan.

Cross-Border Taxation

VAT Registration Cancellation Application Form

This document is the HMRC application form for cancelling VAT registration. It provides essential guidance on completing the form accurately. Ensure compliance to avoid potential penalties.