International Tax Documents

Cross-Border Taxation

Withholding Credits on U.S. Source Income

This memorandum discusses withholding credits related to U.S. source income. It provides guidance on filing Form 1040-NR for foreign complex trusts. U.S. beneficiaries will find relevant creditability information within.

Cross-Border Taxation

Instructions for Form 943-A Agricultural Tax Reporting

This document provides detailed instructions for Form 943-A, used by agricultural employers to record federal tax liabilities. It outlines eligibility criteria, filing procedures, and various tax credits applicable to businesses. Understanding these instructions is crucial for ensuring compliance with IRS requirements.

Cross-Border Taxation

VAT Cancellation Application Form Guide

This file provides a comprehensive guide to cancelling your VAT registration. It includes essential instructions for filling out the application. Follow the outlined steps to ensure a smooth registration cancellation process.

Cross-Border Taxation

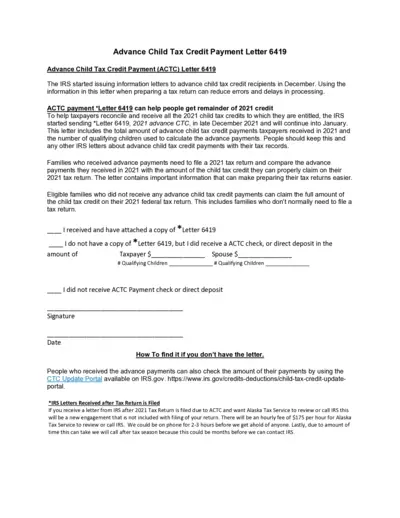

Advance Child Tax Credit Payment Letter 6419

This file contains important information regarding the Advance Child Tax Credit Payment. It assists taxpayers in reconciling their 2021 tax returns. The letter includes details needed to ensure all eligible credits are claimed.

Cross-Border Taxation

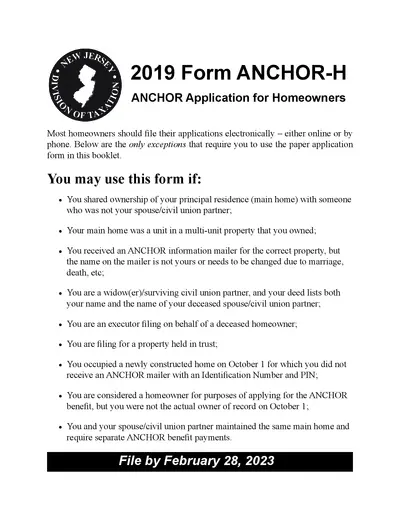

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Cross-Border Taxation

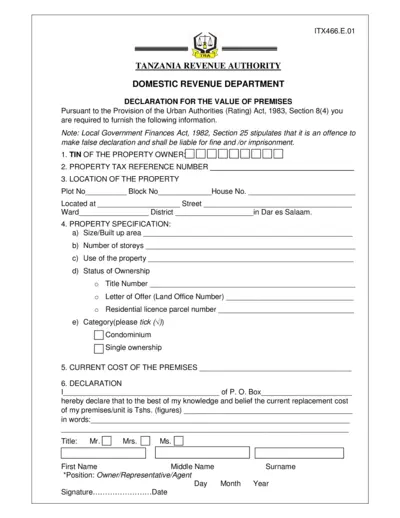

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

Cross-Border Taxation

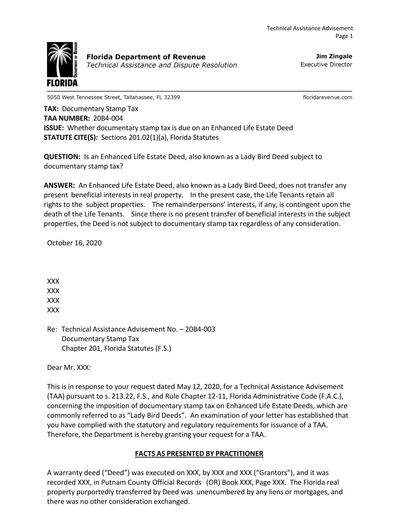

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Cross-Border Taxation

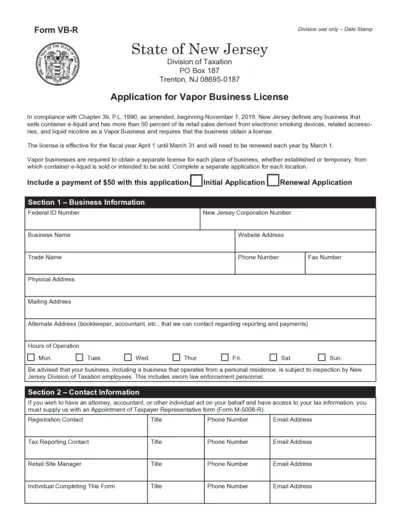

New Jersey Vapor Business License Application

This file is an application for a New Jersey Vapor Business License. It includes various sections for business information, contact details, ownership details, and types of products sold. It must be completed and submitted with a $50 payment.

Cross-Border Taxation

Audit Report for Tamil Nadu VAT Compliance

This audit report is vital for businesses to comply with the Tamil Nadu Value Added Tax Act. It ensures accurate reporting of tax details. Complete the form to validate compliance and audit procedures.

Cross-Border Taxation

Application for Registration - BIR Form 1904

This file contains the application form for registration with the Bureau of Internal Revenue in the Philippines. It includes essential details for both individuals and non-individuals applying for a Tax Identification Number (TIN). Use this document to ensure compliance with tax regulations.

Cross-Border Taxation

New York City Parking Tax Exemption for Residents

This document provides detailed information on the New York City Parking Tax Exemption for Manhattan residents. It outlines criteria, procedures, and eligibility requirements for obtaining the exemption. It is crucial for residents seeking tax relief on parking services within Manhattan.

Cross-Border Taxation

VAT Registration Cancellation Application Form

This document is the HMRC application form for cancelling VAT registration. It provides essential guidance on completing the form accurately. Ensure compliance to avoid potential penalties.