International Tax Documents

Cross-Border Taxation

Documentation Upload Tool User Instructions

This document provides details about the Documentation Upload Tool (DUT) system. It explains how to navigate and utilize the file effectively. Users will find important information about the system's function and submission guidelines.

Cross-Border Taxation

URA Simplifies TIN Registration Process

The Uganda Revenue Authority has launched a simplified web-based TIN registration process. This new system enhances user experience and expedites application procedures. Individuals can now apply for their Tax Identification Number conveniently online.

Cross-Border Taxation

NY State Motor Vehicle Sale or Gift Transaction Form

This form is required for the sale or gift of motor vehicles in New York State. It captures essential information like the new owner's details, the previous owner, and transaction information. Ensure to complete all necessary sections to avoid delays.

Cross-Border Taxation

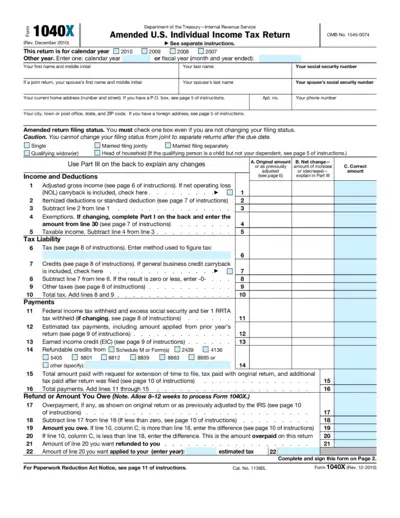

Amended U.S. Individual Income Tax Return (Form 1040X)

Form 1040X is the Amended U.S. Individual Income Tax Return for correcting your previously filed tax return. This form allows taxpayers to make changes to their filing status, income, deductions, or credits. It's essential for ensuring your tax records are accurate and up to date.

Cross-Border Taxation

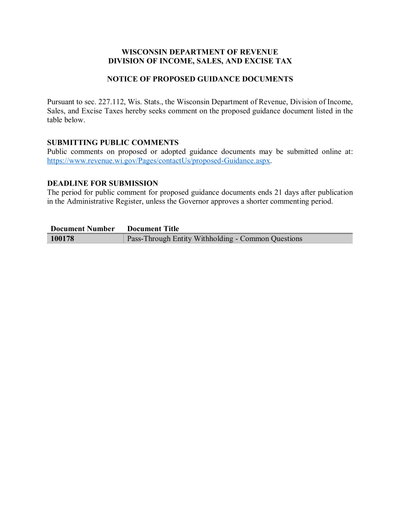

Wisconsin Pass-Through Entity Tax Guidance Document

This file provides essential guidance on Wisconsin's Pass-Through Entity withholding requirements. It outlines who needs to file, how to pay withholding taxes, and addresses common questions. Business owners and tax professionals will find this document invaluable for compliance and understanding tax obligations.

Cross-Border Taxation

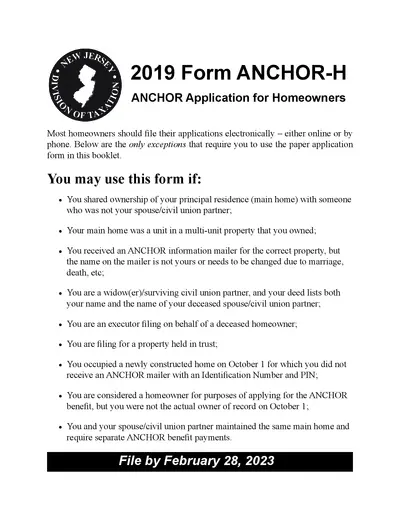

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

Cross-Border Taxation

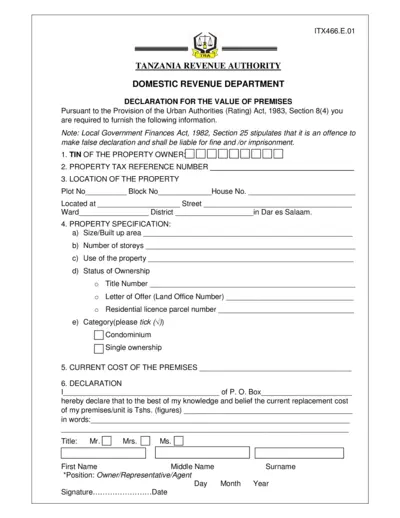

Tanzania Premises Value Declaration Form

This document is used for declaring the value of premises in Tanzania as required by the Urban Authorities (Rating) Act, 1983. It must be filled out by the property owner or their representative, providing information on property location, specifications, current cost, and ownership details. Failure to provide accurate information could result in fines or imprisonment as per the Local Government Finances Act, 1982.

Cross-Border Taxation

Florida Department of Revenue: Technical Assistance Advisement

This document from the Florida Department of Revenue provides a Technical Assistance Advisement (TAA) regarding the application of documentary stamp tax on Enhanced Life Estate Deeds, also known as Lady Bird Deeds. It outlines the specific statutes involved, the request for an advisement, and the ruling on the tax implications.

Cross-Border Taxation

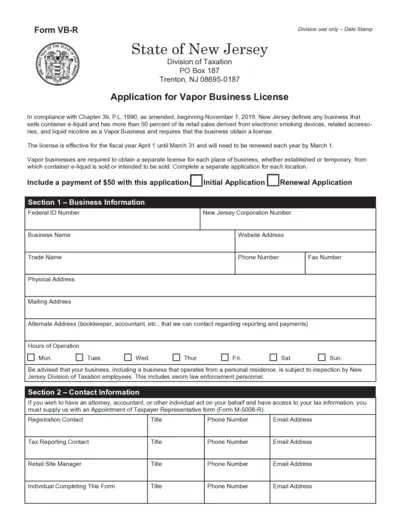

New Jersey Vapor Business License Application

This file is an application for a New Jersey Vapor Business License. It includes various sections for business information, contact details, ownership details, and types of products sold. It must be completed and submitted with a $50 payment.

Cross-Border Taxation

Audit Report for Tamil Nadu VAT Compliance

This audit report is vital for businesses to comply with the Tamil Nadu Value Added Tax Act. It ensures accurate reporting of tax details. Complete the form to validate compliance and audit procedures.

Cross-Border Taxation

Application for Registration - BIR Form 1904

This file contains the application form for registration with the Bureau of Internal Revenue in the Philippines. It includes essential details for both individuals and non-individuals applying for a Tax Identification Number (TIN). Use this document to ensure compliance with tax regulations.

Cross-Border Taxation

New York City Parking Tax Exemption for Residents

This document provides detailed information on the New York City Parking Tax Exemption for Manhattan residents. It outlines criteria, procedures, and eligibility requirements for obtaining the exemption. It is crucial for residents seeking tax relief on parking services within Manhattan.