Business Tax Documents

Payroll Tax

Intuit Payroll Report Solutions and Management

This file contains detailed information about Intuit's payroll solutions and the reports available through Full Service Payroll and Assisted Payroll. Users can manage and track their payroll effectively using the outlined reports. It also provides important comparisons with Complete Payroll, which is being discontinued.

Sales Tax

Younique General Conditions of Sale Overview

This document outlines the General Conditions of Sale for Younique products. It includes information about products, pricing, payment, delivery, and customer rights. Essential for customers engaging in purchasing Younique products.

Sales Tax

Lawn Mower Bill of Sale Document

The Lawn Mower Bill of Sale is a legal document used for the sale and transfer of ownership of a lawn mower. This form ensures that all pertinent information, including the condition and specifications of the mower, is clearly documented for both buyer and seller. It is crucial for maintaining a record of the transaction and protecting both parties' rights.

Payroll Tax

Setup Online Payslips: A Step-by-Step Guide

This file provides a comprehensive guide to setting up online payslips through Sage. It outlines essential steps needed to ensure all employees can access their payslips effortlessly. Perfect for HR professionals and business owners looking to streamline payroll processes.

Sales Tax

AstaAmerica Terms and Conditions of Sale

This document outlines the terms and conditions of sale for Asta America products and services. It provides important information regarding pricing, payment, and warranties. Businesses and individuals should refer to this document for a comprehensive understanding of their purchasing obligations.

Payroll Tax

Itemised Pay Slip Template for Employers and Staff

This document provides a detailed itemised pay slip template for employers and employees. It helps to outline salaries, deductions, and overtime pay clearly. Perfect for businesses looking to maintain transparency in payroll processes.

Payroll Tax

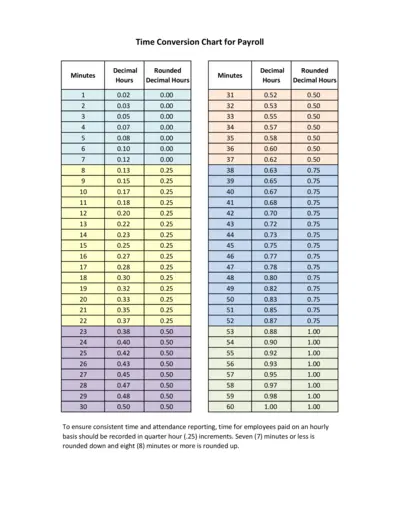

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

Payroll Tax

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

Payroll Tax

2023-2024 Biweekly Payroll Schedule Template

This file is a biweekly payroll schedule template for the years 2023 and 2024. It helps businesses plan and track payroll dates efficiently. Users can enter dollar amounts on scheduled pay dates.

Sales Tax

Salesforce Lead Capture for Sales Cloud User Guide

This user guide provides comprehensive instructions on how to effectively capture leads using Salesforce for Sales Cloud. It covers step-by-step processes for creating tasks, importing leads, and viewing captured data. Perfect for sales teams looking to optimize lead management.

Payroll Tax

Paychex Flex App User Instructions for Employees

This file provides essential instructions for employees using the Paychex Flex app. It covers registration, app features, and security measures. Follow these guidelines to make the most of your Paychex experience.

Payroll Tax

TIEM32 Payroll March 2019 Instructions and Guide

This document contains essential payroll instructions for March 2019. It provides version details and revision history. Ideal for users needing guidance on payroll processing.