Payroll Tax Documents

Payroll Tax

Employee Holiday Pay Instructions for Timesheets

This document outlines the process for adding the Juneteenth holiday to employee timesheets. It specifies the guidelines for both full-time and part-time employees regarding holiday pay. It serves as a crucial reference for supervisors and approvers to ensure accurate payroll processing.

Payroll Tax

California Payday Notice and Employee Payment Schedule

This document outlines the payday notice and payment schedule for employees of Dickinson College in California. It includes information for both non-exempt and exempt employees regarding their pay frequency and deposit methods. Ensure to follow the guidelines provided for timely and correct salary payments.

Payroll Tax

Alaska DOT&PF Payroll Template - Over 50 Employees

This guide provides essential instructions for using the payroll template designed for organizations with over 50 employees. It ensures accurate payroll data conversion and submission. Follow the steps carefully to streamline your payroll processing.

Payroll Tax

IRIS Payroll Professional Car and Fuel Benefit Guide

This document provides comprehensive instructions on managing car and fuel benefits in payroll. It includes how to add, edit, and allocate cars to employees. Understanding this guide is essential for employers managing benefits for their staff.

Payroll Tax

University of Toledo Overpayment Repayment Guidelines

This document outlines the procedures for notifying the Payroll Department of salary overpayments. It provides detailed instructions for active and terminated employees regarding repayment options. Understanding these guidelines is essential for managing payroll discrepancies effectively.

Payroll Tax

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

Payroll Tax

Earnings Statement Instructions and Format Guide

This document provides detailed instructions on how to fill out and interpret the earnings statement. Users can easily navigate the various fields and understand what information is required. This guide serves as a comprehensive resource for new and existing employees needing assistance with their paystub.

Payroll Tax

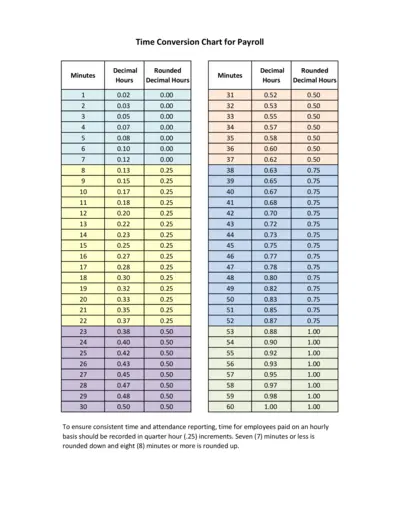

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

Payroll Tax

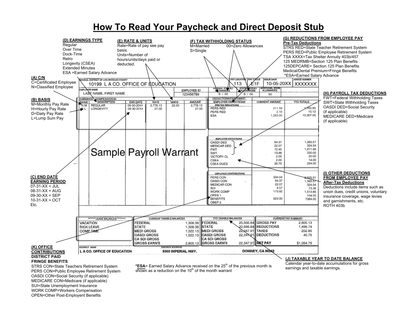

Understanding Your Paycheck and Direct Deposit Stub

This file helps employees understand their paycheck and direct deposit stub. It includes various sections explaining earnings types, tax withholding status, and deductions. Perfect for those who need clarity on their payroll system.

Payroll Tax

Intuit Payroll Report Solutions and Management

This file contains detailed information about Intuit's payroll solutions and the reports available through Full Service Payroll and Assisted Payroll. Users can manage and track their payroll effectively using the outlined reports. It also provides important comparisons with Complete Payroll, which is being discontinued.

Payroll Tax

Employee Direct Deposit Authorization Form Instructions

This document provides instructions for employees to set up direct deposit for their paychecks. It includes detailed steps for completing the authorization form. Employers must maintain this form for their records.

Payroll Tax

W-2 Year-End Tax Documents Access Guide

This guide provides instructions for accessing your W-2 tax documents on Workday. Learn how to view, print, and update your tax document preferences. Ensure you have the necessary information to manage your year-end tax documents effectively.